On December 19, we visited the Ebisu Headquarter of AlphaPolis Co., Ltd. (hereinafter referred to as “AlphaPolis” or “the company”), one of our core investees. During this visit, we conducted interviews and engaged in discussions with the executive management team. We would like to take this opportunity to briefly share our findings with all stakeholders who maybe interested in the company for different reasons.

To conclude, we left with a renewed impression of the company as “a giant awakening.” Since submitting and publicly sharing our proposal for corporate value enhancement back in March, we have maintained ongoing dialogue with the company on various occasions. During this time, the company has announced a series of initiatives fast, including its first-time-ever dividend payment, a public stock offering by the founding family to increase float, and a stock split (3 for 1 for December-end shareholders). We interpret these measures to improve shareholder returns and enhance liquidity as a strong demonstration of the company’s commitment to growth as a public company. We sincerely hope that the company will continue to advance steadfastly in this direction.

The business continues to perform robustly, with the anticipated cycle of attracting new fans steadily taking shape. This includes the amplification effect where anime adaptations generate new fans who then purchase related e-books, bringing benefits back to the company and reinforcing its value chain. The company’s strength lies in its position as one of the leading UGC (User-Generated Content) platform, with a value chain centered on making it into manga and subsequent into anime production. This framework serves to fully leverage the company’s strength in huge talent pool. Globally, the so-called ” Isekai ” genre continues to enjoy a steady wave of popularity. Building on this momentum, the company appears to be capitalizing on this trend, successfully maintaining a well-functioning cycle of e-book publishing and anime production.

However, a potential challenge for the company moving forward lies in its ability to secure sufficient animation studios to meet the rapidly increasing demand. Underlying this issue are concerns related to labor conditions and a shortage of skilled personnel. To address this, the company is reportedly exploring a wide range of solutions, including M&A strategies. As Japanese manga and anime rapidly evolve into global IPs, even for major players such as KADOKAWA Corporation and IG Port, Inc. (“IG Port”), the efforts to “industrialize” manga and anime production still remain a work in progress.

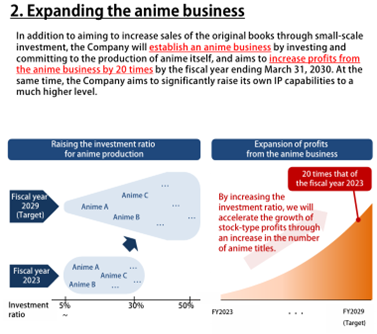

Looking ahead, the company has announced a strategy to expand investments in animation projects of its own content, taking on appropriate risks and aiming to significantly increase recurring revenue from its IP library (see figure below). While this strategy may lead to larger business volatility during the next three to four years of “seeding phase”, we believe it is an essential step for the long-term growth of AlphaPolis. Just like when company newly entered manga publication business around 2015, then transforming it into its current core business, we view the decision by CEO Kajimoto to shift toward expanding IP anime adaptations and investments as the correct move. As a shareholder, we wholeheartedly support this initiative, encouraging the company to take bold risks with a cool eye to pick the right opportunities.

Figure1: AlphaPolis’s anime business expansion policy

Source: AlphaPolis’s “Second Quarter of the Fiscal Year Ending March 31, 2025 Financial Results Briefing Material”

Building on this, we offered two key points of constructive criticism from a broader perspective, with the intention of providing both encouragement and guidance: (1) improving investor relations activities, and (2) enhancing financial strategies.

(1) improving investor relations activities

We reiterated the importance of continuing efforts to expand the investor base through liquidity improvement measures, such as share offerings and stock splits, which have been implemented to date. Furthermore, we suggested that the company adopt a more proactive approach to enhancing recognition among sell-side analysts at securities firms.

As Japanese IP gains increasing global recognition, the company has also found itself in an environment where it is attracting significantly more attention from investors than before. However, this heightened interest will inevitably lead to a surge in investor meeting requests, resulting in a substantial increase in workload and complexity for IR activity. In this context, we believe that a (current) purely reactive approach to handling incoming requests is insufficient. Instead, proactively educating investors by leveraging sell-side analysts can ultimately make IR work both more efficient and more effective. In this context, we suggested that the company increase the variety of its IR activities, starting from creating more opportunities for small group meetings where the CEO Kajimoto serves as the speaker, which have so far been only limited to financial results presentations. Additionally, we recommended that the company diversify its IR initiatives by incorporating activities such as small meetings hosted by securities firms, improved website content, and direct 1×1 IR meetings. By adopting a “zone offense” approach, we encouraged the company to strategically build a comprehensive framework for IR activities.

We emphasized the importance of steadily and consistently implementing a multifaceted strategy to enhance investor recognition and reduce risk premiums. As an example of success, we shared the case of IG Port (3791), where our representative, Yuya Shimizu, serves as an external advisor. This example was briefly discussed during the meeting. In July, IG Port’s website was significantly updated to clearly showcase the revenue cycle of the anime production business, from creation to investment. IG Port’s open and straightforward approach to explaining its business model, which has traditionally been challenging for investors to grasp, is highly commendable. This effort has not only boosted the company’s stock performance but also enhanced the brand value of the entire group. We strongly encourage AlphaPolis to consider adopting a similar approach.

(2) enhancing financial strategies

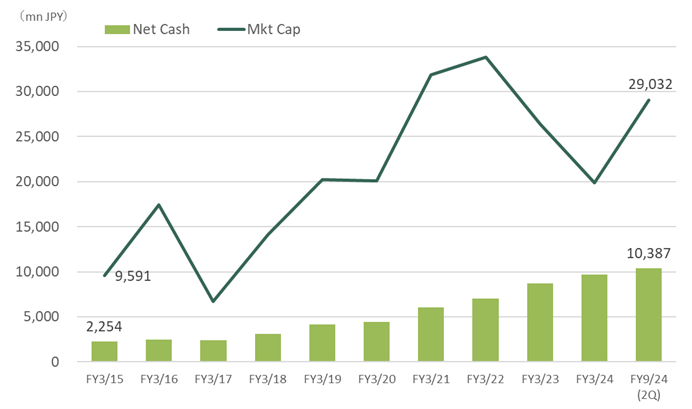

With respect to financial matters, as highlighted in our earlier proposal letter, the steady accumulation of net cash remains is ongoing. In this regard, we requested measures to achieve “improved visibility on its financial strategies,” ensuring that investors can better interpret the company’s strategy through information on its financial practices.

As of the second quarter of FY2024 (interim period), supported by strong business performance, net cash surpassed the significant milestone of 10 billion yen. Accounts receivable, caused by relatively long payment terms from e-book stores and distributors, stood at 3.2 billion yen for the interim period, approximately one-fourth of annual sales, which is relatively high. However, since the company is not a traditional manufacturing business, inventory levels are almost zero, and annual working capital requirements remain at approximately 3 billion yen. Given this context, the net cash of 10 billion yen is roughly ten times the monthly revenue, creating an undeniable sense of excess.

Figure2: AlphaPolis’s Net Cash and Market Capitalization Trends

Note: The latest net cash is from the interim financial statement, and the market capitalization is based on the closing price at the end of November.

(Source: prepared by Hibiki using the company’s financial statements and Bloomberg)

Each time when I enquired about this issue, the explanation always centered on “standby funds for executing M&A transactions in a quick and flexible manner without the need to obtain borrowings.” However, it should be noted that for promising M&A opportunities, securing financing from banks is generally easy (they are eager to lend to a good projects). Furthermore, AlphaPolis already has small amount of borrowings which means it already has bank relationships. In light of this, we recommended that AlphaPolis establish an ROE target and streamline its financial structure in pursuit of this objective. A “good (rich) valuation,” supported by strong business performance and a robust financial structure, is effective not only in securing bank financing but also in obtaining flexibility in M&A strategies (e.g. stock swap offer). Companies with a clear focus on ROE and similar metrics are more likely to receive favorable evaluations from institutional investors, which, in turn, helps the diversification and institutionalization of ownership structures.

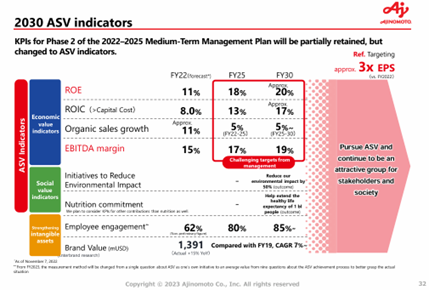

Furthermore, it is interesting that the company has a strong independent director, Mr. Takuya Shiraishi, who is an expert in digital strategy. He currently holds the position as an CEO Advisor at Ajinomoto Co., Inc. (hereinafter referred to as “Ajinomoto”) and is recognized for his extensive knowledge and strategic thinking. Ajinomoto announced the “Medium-Term ASV Initiatives 2030 Roadmap” in 2023, which includes an outstanding slide (below). In the slide, the company has quantified its desired future state as much as possible and set high targets, demonstrating a strong commitment also with financial aspects, clearly presented to the capital market. Notably, the ROE has been disclosed with specific quantitative targets, increasing from the current low 10% range to 18% by FY25 and 20% by FY30.

Figure3: Ajinomoto’s financial KPIs

Source: Ajinomoto’s IR page

The methods by which companies express their medium- to long-term goals vary greatly depending on their business characteristics, and we acknowledge that it would not be appropriate to impose a specific format. However, bottom-line basis, we strongly believe that public companies are obligated (as a fiduciary duty) to clearly show company’s targeted ROE to shareholders. We strongly hope that AlphaPolis will actively seek and benefit from the valuable insights and advice of Mr. Shiraishi, who possesses extensive experience. In the near future, we eagerly wish to see AlphaPolis evolve with a more finance-oriented mindset. By harmonizing a “strong business” and “corporate financial thinking” as complementary forces, much like the front and rear wheels of a bicycle working in unison, AlphaPolis will undoubtedly become an unstoppable force.

We will continue to engage actively with the management in the years to come!

Happy holidays in 2024!

While every effort has been made to ensure the accuracy of the data and information contained in this post, the accuracy cannot be guaranteed. This post does not constitute a solicitation to subscribe for, or a recommendation to buy or sell, any specific securities, nor does it constitute investment, legal, tax, accounting, or other advice.