DIC Corporation (“DIC”), the largest shareholder of Taiyo Holdings Co., Ltd. (“THK”) with a 20.04% stake, announced today that it will vote against the reappointment of Mr. Eiji Sato, Representative Director and President of THK, at the upcoming Annual General Meeting. This development is being regarded as a significant event within the capital markets, given THK’s historically strong reputation.

The reason for DIC’s opposition to the reappointment of Mr. Eiji Sato as Representative Director and President of THK is explicitly stated in the press release issued yesterday (June 3, 2025) as follows.

Figure 1: Disclosed comment by DIC

(Source: Excerpt from DIC’s official website)

This announcement has come as a surprise to us as well.

However, as many of you may already be aware, we, Hibiki Path Advisors (hereinafter referred to as “we”), have also been actively engaged in submitting shareholder proposals and conducting a campaign with respect to JAPAN PURE CHEMICAL CO., LTD. (hereinafter referred to as “the Company”), a company closely associated with THK. In our capacity as the largest shareholder with a 18.19% ownership stake (as reported in the change report submitted on May 22), we are undertaking these actions to safeguard the common interests of all shareholders.

Similarly to DIC, we, as the largest shareholder of the Company with an 18.19% ownership stake, are firmly opposed (as currently planned) to the proposed transition to a company with an Audit and Supervisory Committee (Agenda Item 1: Partial Amendment to the Articles of Incorporation). Our opposition is based on concerns that delegating significant executive authority to directors may lead to inadequate discussion and record-keeping within the board, the loss of independent auditing authority by statutory auditors, and ultimately, a decline in governance standards. Furthermore, there is an increased risk that such a transition would reinforce the de facto control of the Company by Director and Honorary Advisor Mr. Masao Watanabe.

Furthermore, we have expressed our opposition (confirmed) to Mr. Masao Watanabe, Director and Honorary Advisor (Candidate No. 3 under Agenda Item 2), who continues to retain a strong influence within the organization despite not having delivered results that meaningfully contribute to the enhancement of corporate value. We respectfully urge all shareholders, including those with close ties to the company through strategic shareholdings, to make a reasoned and objective assessment in light of the Company’s long-term trends in corporate value, share price, and business performance. In particular, for shareholders presumed to hold shares for strategic purposes, we intend to follow up directly after the Annual Shareholder Meeting to verify how voting rights were exercised.

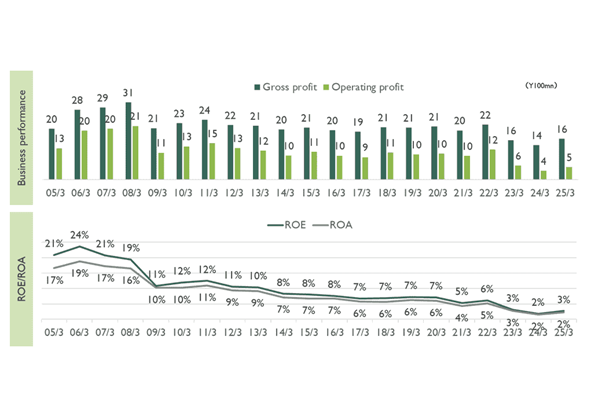

For reference, the Company’s past business performance is shown below.

Figure 2: Long-Term Performance Trends and Capital/Asset Efficiency of the Company

Note: The numerator for ROE and ROA is calculated by multiplying operating profit by (1 – tax rate) for each respective year.

Note: The numerator for ROE and ROA is calculated by multiplying operating profit by (1 – tax rate) for each respective year.

(Source: Prepared by Hibiki based on Bloomberg and the Company’s Annual Securities Reports, etc.)

With respect to the THK matter, we once again respectfully ask all shareholders to calmly and rationally assess whether there is any material difference between the views expressed by DIC, a major shareholder of THK, and the requests we have made to the Company as its largest shareholder, holding an 18.19% stake.

Our position for the Company is outlined below.

(Reference: Our Statement Regarding the Proposed AGM Agenda Items)

<Company Proposals>

・(AGM item 1) We oppose the partial change of the Articles of Incorporation (Planned)

Reasons: We have serious concerns that such a shift may increase the risk of weakened governance— due to factors such as the delegation of important business execution to Internal Executive Directors, the potential for insufficient discussion and recordkeeping at the Board level, and the loss of independent audit authority previously held by statutory auditors. We are deeply concerned that these developments may ultimately contribute to reinforcing Mr. Watanabe’s de facto control of the Company.

・(AGM Item 2 candidate No.3) We oppose the Company’s proposal to reappoint the Director and Honorary Advisor Mr. Masao Watanabe (Confirmed)

Reasons: We believe that a major reason the Company has been unable to implement fundamental measures to overcome its three critical resource deficiencies is attributable to Director and Honorary Advisor Mr. Masao Watanabe, who has effectively held control as Representative Director for over 20 years since the MBO and has continued to exert de facto control under the title of Director and Honorary Advisor even after stepping down as Representative Director. From the perspective of enabling the Company to make bold decisions going forward and embark on a new “third founding age,” we consider it indispensable that Director and Honorary Advisor Watanabe relinquish his position as Director. Under a new management structure, it is essential to establish a system whereby management, shareholders, and employees can unite to overcome the current challenges.

・(AGM Item 2, 3, 4) planned opposition to the election of eight other Director nominees, excluding Mr. Tomoyuki Kojima (AGM item 2 candidate No.1) and Ms. Momoe Kuromatsu (AGM item 2 candidate No.6) (Planned)

Reasons: We believe that for the Company to carry out meaningful reforms aimed at enhancing corporate value, it is essential to fundamentally restructure the composition of the Board of Directors, which has long relied on appointments from a limited pool of affiliated backgrounds. As the largest shareholder, we hope to work collaboratively with Representative Director Mr. Tomoyoshi Kojima and Outside Director Ms. Momoe Kuromatsu, for whom we plan to support reappointment, to identify and nominate truly qualified director candidates who can contribute to the Company’s corporate value enhancement. We look forward to having these candidates presented for shareholder approval at an Extraordinary General Meeting. Regarding the four Audit and Supervisory Committee members (including the alternate candidate), we cannot assess their suitability. Additionally, as we plan to oppose the Company’s transition to a company with an Audit and Supervisory Committee, we plan to oppose their appointment accordingly. Regarding the other four Directors—Mr. Motoki Watanabe, Mr. Yasutoshi Ohata, Mr. Isamu Kawashima, and Mr. Hiroshi Hayashi, these individuals have a background of having been affiliated with specific companies, whose presence on the Board has continuously persisted over time. This raises significant doubts about their actual independence. For these reasons, we plan to oppose their reappointment. Specifically, Mr. Motoki Watanabe serves as an Executive Director overseeing accounting and finance, and is responsible for improving asset efficiency and achieving an optimal capital structure to enhance corporate value—areas on which we have repeatedly called for progress over the past several years. However, given the lack of sufficient advancement, we plan to oppose his reappointment.

Please note that the items currently marked as “planned” are subject to change, as we are scheduled to hold a meeting with the Company within the next few days. Should our judgment change as a result of this meeting, we intend to disclose the reasons and details of our revised decision separately.

<Shareholder proposals>

・Shareholder proposal (AGM Item 10): Enhancement of stock-based compensation for Directors (excluding Outside Directors) – Support (Confirmed)

Reasons:We believe that the primary reason the Company continues to operate in a manner that neglects the common interests of shareholders is that the current compensation structure does not sufficiently incentivize management to focus on increasing corporate value and share price.

To achieve “sufficiently incentivizing management to focus on enhancing corporate value and share price”, it is critical to align the interests and perspectives of management with those of the general shareholders, including the largest shareholder. Without a performance-linked compensation structure where management enjoys meaningful economic gains when the share price rises along with corporate value, and conversely incurs personal financial losses when corporate value deteriorates and the share price falls due to managerial missteps, the Company will remain trapped in a defensive, self-preserving management stance, as is currently the case. Furthermore, as noted in the “Reason for Proposal – Item 1” section, the Company’s performance has been sluggish not only in recent years but over the long term. Despite this, the monetary compensation per Director (excluding Outside Directors) has shown an increasing trend. A compensation scheme that allows monetary rewards to rise while operating profit and capital efficiency remain stagnant is fundamentally misaligned with the interests of shareholders, including the largest shareholder, and cannot be overlooked. Under these circumstances, we strongly hope that the incentive structure will be revised so that Internal Directors receive stock-based compensation at a level equivalent to their monetary compensation every year. By doing so, we believe they will be better aligned with shareholders’ perspectives and be more personally committed to driving corporate value creation. We also strongly hope that, like shareholders, Internal Executive Directors will be able to experience and cherish the gains resulting from their effort to increase corporate value. For these reasons, we have chosen to bring forward this proposal.

・Shareholder proposal (AGM Item 11): Partial amendment to the Articles of Incorporation regarding the decision-making body for matters such as surplus dividends – Support (Confirmed)

Reasons:we propose a partial amendment to the Articles of Incorporation concerning the decision-making body for dividends and other surplus distributions, as a prerequisite for submitting the point mentioned as follows, which relates to strengthening shareholder returns (Item 12 and 13). Article 459, Paragraph 1 of the Companies Act stipulates that, in principle, matters such as dividends of surplus should be resolved at the General Meeting of Shareholders. However, under Article 44 of the Company’s Articles of Incorporation, the authority originally vested in the General Meeting of Shareholders for these matters has been transferred to the Board of Directors. Thus, the Board of Directors has the authority to make decisions on the distribution of surplus, etc., without the influence of the General Meeting of Shareholders, which, in principle under the Companies Act, is supposed to have the authority to make such decisions. We believe that this provision of the Articles of Incorporation could lead to arbitrary decisions on the amount of dividends, etc., without taking into account the status of surplus assets of the Company.

We believe it is important to reaffirm the principle that shareholders are the owners of the company, and that matters which the Companies Act designates as requiring resolution by the general meeting should, as a rule, be decided by the shareholders themselves. In comparison with the proposed amendment, the current Articles of Incorporation appear to have the intent of excluding the authority of the general meeting of shareholders. We find no reasonable justification for such exclusion, and for that reason, we hereby submit this proposal.

・Shareholder proposal (AGM Items 12 and 13): Strengthening of shareholder returns to improve ROE (including share buybacks and increased dividends) – Support (Confirmed)

Reasons:As stated in our disclosed discussion material with the Company released in February 2023, we believe that the most critical issue hindering the enhancement of the Company’s corporate value is the persistently low return on equity (ROE), caused by the excessive accumulation of cash and deposits and the continued holding of cross-shareholdings.

We have submitted a proposal to partially amend the Articles of Incorporation and strengthen shareholder returns to improve ROE. Our objective is to fundamentally improve ROE by promptly reducing or effectively utilizing the Company’s excess cash and investment securities, along with intentionally optimizing the level of net assets. As a first step in setting this direction, we are proposing these shareholder proposals to enable shareholder returns funded by approximately 7.6 bn yen in accumulated cash and deposits (equivalent to approximately 1,313 yen per share), through the partial sale of investment securities.

Please refer to the following for an overview of our campaign activities concerning the Company over the past month.

(Reference: Public Campaign Concerning JAPAN PURE CHEMICAL CO., LTD.)

28/May/2025 ー Publication on DIAMOND online regarding JPC campaign

22/May/2025 – Commentary of the shareholder proposal to JAPAN PURE CHEMICAL CO., LTD.

This post does not constitute a solicitation to subscribe for, or a recommendation to buy or sell, any specific securities, nor does it constitute investment, legal, tax, accounting, or other advice.