On November 14, our key portfolio company, Tomoe Corporation (“the Company”), announced its 2Q FY3/26 results. On September 12, we submitted a formal request to the Company calling for the establishment of a special committee to review its medium-term plan and decide whether to maintain its listing or explore potential privatization. We also asked that the Company express its stance on our proposals around the time of its interim results, via a press release or other appropriate means. Regrettably, the Company provided no response whatsoever, limiting its disclosure solely to the financial results so far.

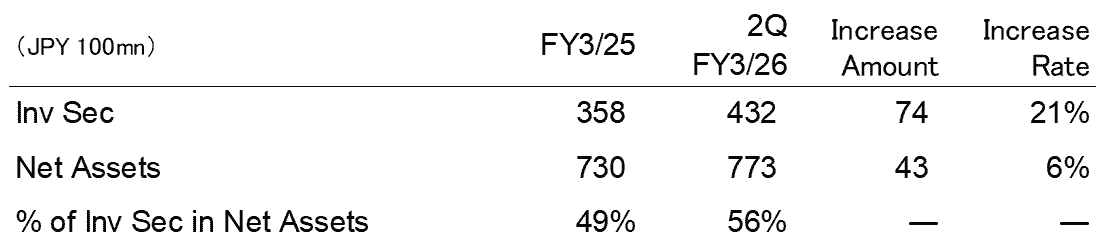

Reviewing the 2Q FY3/26 earnings release, there is no sign of any proactive initiatives to enhance corporate value, including those we have recommended. On the contrary, actions such as the purchase of JPY 1.1 bn in investment securities suggest a continuation of self-preserving corporate behavior. Coupled with the recent rise in the stock market, the value of investment securities has climbed to JPY 43.2 bn (up from JPY 35.8 bn at the previous fiscal year-end), now accounting for 56% of net assets (versus 49% previously).

Despite a significant downward revision to its first half guidance (Japanese Only) on November 10 (sales -15.3%, operating profit -21.3%), the Company has provided neither a detailed explanation nor any capital measures to address these issues. Instead, management seems content to persist with incremental measures, leaving us deeply disappointed.

Figure 1: Rising Investment Securities

Source: 2Q FY3/26 Earnings Release

We confirmed in the FY3/25 securities report that the Company purchased shares in two additional companies as part of its policy holdings during the last fiscal year. Despite explicitly stating in its revised medium-term plan disclosed in May this year (Japanese Only) that it would “gradually and systematically reduce policy holdings,” the Company has deliberately dismissed initiatives to enhance corporate value.

If management lacks the willingness to undertake fundamental reforms to boost corporate value, it must seriously consider all available options—without prejudice—including privatization through a management buyout (MBO) or being brought under the umbrella of the group of its policy-held companies. From the standpoint of safeguarding collective shareholder interests, we are prepared to take further action, including exercising our shareholder rights.

We call on our fellow shareholders and, importantly, the employees who are the true source of the Company’s value, to continue supporting our efforts.

This post does not constitute a solicitation for an offer to acquire or recommend the purchase or sale of specific securities, or advice on investment, legal, tax, accounting, or any other matters. In the event of any discrepancy or conflict between the English and Japanese versions, unless otherwise noted, the meaning of the Japanese language version shall prevail unless otherwise expressly indicated.