On October 24, 2025, one of our core portfolio holdings, Japan Pure Chemical Co., Ltd. (“JPC” or “the Company”), announced its earnings and held a financial briefing. While we continue to view JPC’s business fundamentals as highly attractive, we believe the company still falls short in key areas of corporate value enhancement—most notably, balance sheet management. As a significant shareholder, we have been engaging continuously and constructively with the management on these issues and will continue to encourage more decisive actions to unlock the company’s full potential. A summary of our past engagement activities is provided at the end of this post.

The company’s core business lies in the development, manufacturing, and sales of precious metal plating chemicals, with a particular focus on gold. Backed by its exceptional product quality, JPC commands a strong market share in high-end electronics applications such as smartphones, PCs, and servers.

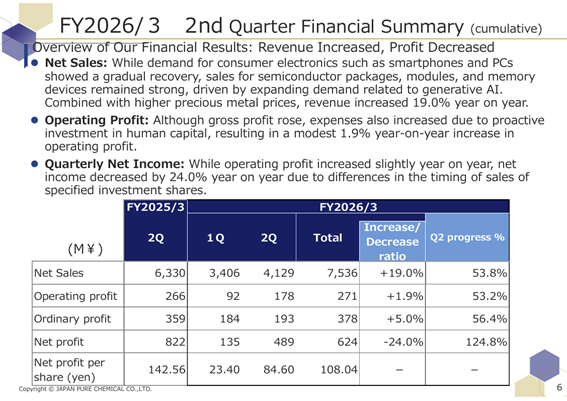

In the 2Q earnings results announced on October 24, JPC reported solid performance driven by strong demand for AI servers and data centers, while demand for its core end applications—PCs and smartphones—showed a gradual recovery after a slow rebound. As a result, gross profit rose 9.1% YoY. Despite increased investment in human capital—particularly in expanding its sales force—operating profit still grew 1.9% YoY, which we view as a positive sign.

Figure 1: Summary of JPC FY3/26 2Q Results

(Source: JPC FY3/26 2Q Earnings Presentation)

(Source: JPC FY3/26 2Q Earnings Presentation)

Looking at the end-market trends (Japanese only), global PC shipments increased 9.4% YoY in the July–September quarter, partly due to the approaching end of Windows 10 support, while smartphone shipments rose 2.6% YoY (with Apple up 2.9%). JPC also highlighted robust demand from AI server and data center applications in its briefing, and we expect the current strength in the AI-related market to continue benefiting JPC’s business performance going forward.

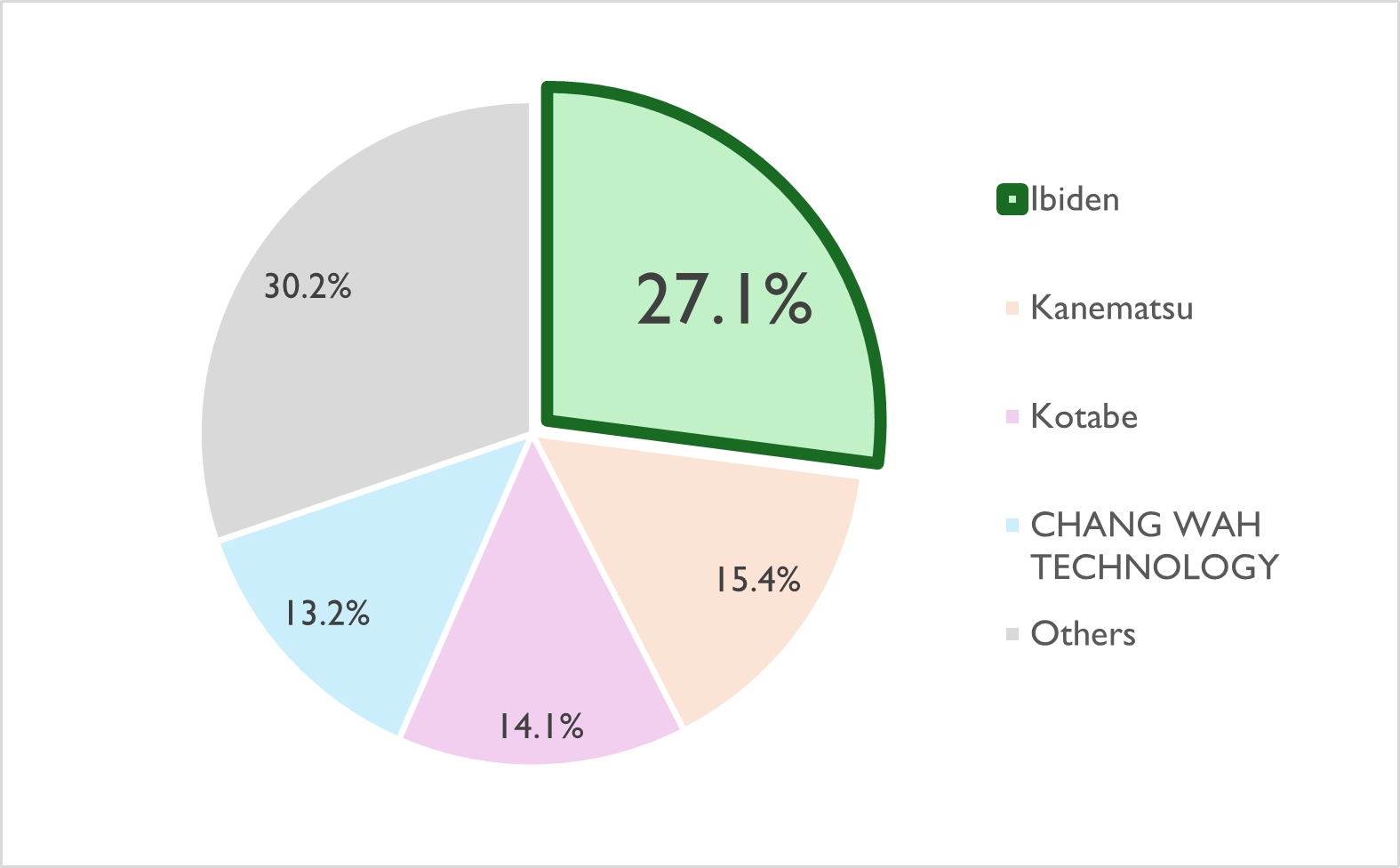

What we’re particularly focused on is the outlook for JPC’s key customer, Ibiden Co., Ltd. (“Ibiden”). As shown below, Ibiden accounted for just under 30% of JPC’s total sales in FY3/25, making it by far the company’s most important client.

Figure 2: Revenue Breakdown by Customer for JPC

(Source: JPC FY3/25 Annual Securities Report)

(Source: JPC FY3/25 Annual Securities Report)

As reported in recent Nikkei articles, Ibiden is enjoying a strong momentum—especially in the area of substrates for generative-AI semiconductors—and is expected to post robust growth. We asked at the earnings briefing, “whether JPC could capture similar upside from Ibiden’s planned scale-up—Nikkei has reported that Ibiden’s production for IC package substrates for generative-AI servers is expected to increase to 2.5x by FY2027 (Japanese only)”. JPC’s reply was cautious: “Because gold plating is used only on surfaces and not in the stacked layers, an increase in substrate area does not automatically translate into a proportional rise in JPC’s plated-volume orders, so the impact is not yet clear.” Nevertheless, we believe JPC should reasonably capture some benefit from higher production volumes, and we expect the company to analyze such upside carefully and communicate, as concretely as possible, what those positives mean for JPC’s earnings.

Overall, we view JPC’s ability to capture new AI-related demand as a constructive sign, and we remain encouraged by the company’s progress in turning such opportunities into sustainable growth.

That said, the company’s persistent weakness in go-to-market capability—especially its limited presence across emerging markets led by China—remains starkly visible in this quarter’s results. In the functional chemicals sector, sales into China can exceed 30% at some peers (e.g., MEC Company Ltd. FY12/24 → 32%; JCU Corporation FY3/25 → 38%), whereas JPC’s China exposure was only 4.6% in FY3/25 and remained low at 3.5% on a standalone basis in 2Q FY3/26. China is rapidly developing an independent ecosystem for advanced technologies, including semiconductors, and represents a material growth market for Japanese functional-chemical suppliers. Despite strong technology, JPC appears to be losing revenue opportunities because of limited customer reach. We strongly encourage management to adopt strategic, growth-minded options—ranging from capital and business alliances to bold M&A—to expand its market footprint rather than remain wedded to a narrow corporate framework.

Finally, on the balance sheet: the company announced intentions to sell some investment securities, but at 2Q-end the balance-sheet carrying value of policy shareholdings rose from JPY 6.0 bn at FY3/25 to JPY 8.4 bn—an increase from 43.9% to 54.1% of net assets. From a shareholder perspective, this further enlarges an exposure to industry-specific risks that far exceed what would be needed to support core operations, which we find undesirable. Management has indicated planned disposals in 3Q that would realize roughly JPY 1 bn in gains at current prices, but the company still retains excess cash that generates returns far below its cost of capital. Maintaining this “metabolic” excess of cash and investment securities creates large sunk costs for shareholders. We therefore strongly urge management to accelerate measures to return excess capital to shareholders.

~~~~~

Shifting focus, we would like to offer our view on broader trends in the functional-chemicals industry—of which JPC is a participant—and share what we see as the major structural forces shaping the sector going forward.

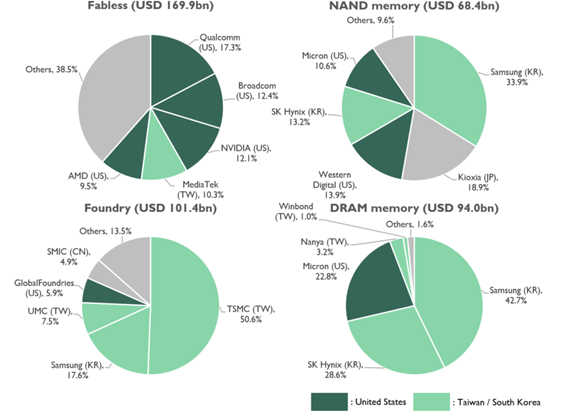

Looking at the semiconductor industry more broadly, since consolidation in the late 1990s, we are now seeing a clear cycle driven by several forces: (1) a rapid surge in demand for compute resources centered on generative AI; (2) companies that are advantaged not just technologically but also in capital scale gaining ground; (3) those firms pursuing bold, fast-paced investments to achieve economies of scale; and (4) an accelerating winner-takes-most dynamic that fuels further capital accumulation for the leaders. Under this growth regime, Japanese firms’ global share has been eroded by Taiwan and Korea, and in leading-edge segments, the dominant structure today typically features U.S.-based design with manufacturing concentrated in Korea and Taiwan.

Figure 3: Share Trends in the Global Semiconductor Industry

(Source: Hibiki, compiled from

METI, June 2023 — Semiconductor & Digital Industry Strategy (Japanese only))

A symbolic event that underscored Japan’s decline in the semiconductor industry was the bankruptcy of Elpida Memory in 2012. Formed through the business integration of NEC and Hitachi in 1999, and later joined by Mitsubishi Electric in 2003, Elpida struggled to maintain the investment scale and policy support required in an intensely competitive field, ultimately filing for corporate rehabilitation under Japan’s Corporate Reorganization Law and effectively going bankrupt, before eventually coming under Micron’s umbrella. In stark contrast, SK Hynix in Korea — which received strong government backing — has since thrived, representing the opposite outcome.

That said, a different perspective emerges when we look at the post-acquisition outcomes.

Micron has invested roughly JPY 1.8 tn in Japan in the eight years following the acquisition of Elpida (Japanese only). Adding to that, retrospective reporting (Japanese only) has highlighted benefits, including 50% higher R&D spending, placing top talent in key positions regardless of nationality, maintaining facilities, and broader regional economic impacts such as infrastructure.

Even when foreign companies possess strong capital and expertise, many Japanese executives feel a psychological resistance, as it can appear that their firms are being swallowed by foreign ownership. Yet in reality, such investments often bring significant benefits: they expand capital inflows into Japan, strengthen technological competitiveness, create jobs, develop highly skilled talent, and stimulate growth in related industries. These broad, positive spillovers contribute meaningfully to Japan’s national strength and should not be overlooked.

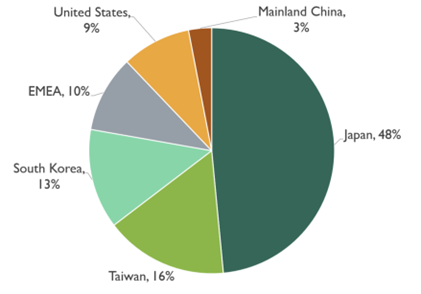

Turning our attention to the semiconductor materials and components industry, Japan still maintains a significant global presence, holding roughly a 50% share in these categories.

Figure 4: Country Shares in Semiconductor Materials and Components

(Source: Hibiki, compiled from

(Source: Hibiki, compiled from

METI, June 2023 — Semiconductor & Digital Industry Strategy (Japanese only))

Precisely because of this, the industry has remained conservative and has seen little consolidation, with numerous small-scale firms persisting in the functional-chemicals sector. Many of these companies possess overwhelming technological capabilities and dominant positions in specific niche areas, and many management teams appear to assume, “In the past, we managed just fine as a small, highly skilled company, so continuing in the same way going forward should be fine.”

This fragmentation is particularly apparent among PCB-related firms: distinct process steps and unique chemistries create natural territorial boundaries, and companies historically have reinforced these boundaries through complex cross-shareholdings to shield themselves from external takeover threats.

Figure 5: Industry Map — Semiconductor-Related Functional Chemicals

(Source: Hibiki, compiled from public information)

(Source: Hibiki, compiled from public information)

By contrast, overseas consolidation has advanced significantly over time. Examples include Rohm and Haas, which became part of Dow Chemical in 2009; Atotech, the world leader in precision plating chemicals, which entered private-equity ownership in 2017, listed on the NYSE in 2021 and was acquired by MKS in 2022 to pursue synergies and Asia expansion; and Coventya, which spun out in an MBO in 2000 and later grew through more than ten acquisitions before joining U.S. MacDermid in 2021. These moves expanded customer access and R&D capabilities and generated exponential growth—strategic playbooks from which Japanese firms should learn.

In light of these trends among overseas companies, we are concerned that if the current situation persists, the same concentration and consequent erosion of Japanese companies’ competitiveness observed in the semiconductor design and manufacturing areas could very well occur in the functional chemicals sector as well.

Recently, activist investors and private equity firms have become increasingly active, and a clear momentum toward industry consolidation is emerging from what has long been a fragmented, “small-state” landscape. For example, Taiyo Holdings, the world’s largest solder-resist manufacturer, has reportedly received multiple proposals from private equity firms. In addition, major semiconductor materials companies such as JSR Corporation, and adjacent industry players like Shinko Electric Industries, have been taken private by the government-backed Japan Investment Corporation Capital (JICC), with the aim of strengthening the semiconductor-related industry from an economic security perspective. In the tender offer filing submitted by JICC’s SPC for JSR, language reflecting the possibility of broader industry consolidation is included.

(Source: JSR press release, March 18, 2024)

History has a way of repeating itself. We believe the time has come to decisively cut old ties and pursue strategic consolidation. We urge the management of JPC—whose scale is by no means large—not to retreat into a small-company mindset or indulge in vanity as leaders of a small firm. Similarly, we encourage many executives across the industry to take a zero-based approach in reconsidering all strategic options, including industry consolidation or joining a larger corporate group, to determine what genuinely enhances corporate value. The combined outcome of these decisions will, without exaggeration, shape the trajectory of Japan’s industrial strength and competitiveness for the next century. This is a call to act boldly, with clarity and purpose, to ensure that the choices made today lay the foundation for long-term national and corporate prosperity (Yuya Shimizu, Fumihiro Kawasaki).

(References)

List of Posts

30/Jul/2025 ー JPC: Revised Large Shareholding Report

27/Jun/2025 — Results of JPC’s 54th Annual General Meeting of Shareholders (comment on voting results)

23/Jun/2025 ー JPC’s 54th Annual General Meeting of Shareholders

16/Jun/2025 – Appointment of an Inspector for the 54th Annual General Meeting of JAPAN PURE CHEMICAL CO., LTD.

11/Jun/2025 – Hibiki Path Advisors finalized Its Policy for the 54th Annual General Meeting of JAPAN PURE CHEMICAL CO., LTD.

7/Jun/2025 – ISS Endorses Hibiki’s Shareholder Proposals to JAPAN PURE CHEMICAL CO., LTD.

4/Jun/2025 – Connecting the developments surrounding TAIYO HOLDINGS with our campaign against JAPAN PURE CHEMICAL CO., LTD.

1/Jun/2025 – Regarding the Public Campaign as the largest Shareholder of JAPAN PURE CHEMICAL CO., LTD.

28/May/2025 ー Publication on DIAMOND online regarding JPC campaign

26/May/2025 ー As the largest shareholder of JAPAN PURE CHEMICAL CO., LTD., requested the Outside Directors to provide their thoughts regarding Hibiki’s opinion

22/May/2025 – Commentary of the shareholder proposal to JAPAN PURE CHEMICAL CO., LTD.

21/May/2025 – Submission of a shareholder proposal to JAPAN PURE CHEMICAL CO., LTD. as its largest shareholder

2/Oct/2024 ー About Letter to the board of directors in Japan Pure Chemical Co., Ltd.

This post does not constitute a solicitation for an offer to acquire or recommend the purchase or sale of specific securities, or advice on investment, legal, tax, accounting, or any other matters. In the event of any discrepancy or conflict between the English and Japanese versions, unless otherwise noted, the meaning of the Japanese language version shall prevail unless otherwise expressly indicated.