This is Yuya Shimizu, Chief Investment Officer at Hibiki Path Advisors. Today, I’d like to share a brief comment on one of our core portfolio holdings, Kawai Musical Instruments Manufacturing Co., Ltd. (“KAWAI” or “the Company”).

The 19th International Chopin Piano Competition — one of the most prestigious piano competitions in the world — is currently underway in Warsaw, Poland. Talented young pianists from around the globe, who have passed an intense preliminary selection process, are now delivering extraordinary performances on this world stage.

The first round, which featured 84 participants, has concluded, and 40 pianists have advanced to the second round, where the competition is heating up. Since the previous competition in 2021, all performances have been streamed live on YouTube, drawing global attention and sparking a huge response from piano fans in Japan as well. The final results are set to be announced on October 20, and anticipation is building for how this world-class competition will unfold.

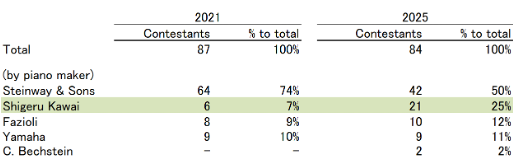

Another unique aspect of this competition is that each contestant must select one piano from a list of approved manufacturers before the competition begins — and then perform on that same instrument throughout all four stages, from the first-round solo performance to the concerto in the final round, which demands both power and endurance. This format is often referred to as a “showcase of piano makers,” as leading manufacturers and their top technicians compete behind the scenes to support contestants in bringing out the fullest expression of their artistry. This year, the five available piano brands are Steinway & Sons, Shigeru Kawai, Yamaha, Fazioli, and Bechstein.

The 2021 competition turned out to be a real turning point for KAWAI. For a long time, Steinway & Sons had been considered the undisputed choice for concert pianists, but as you can see in Figure 1, three out of the twelve finalists were choosing Shigeru Kawai, its top-line brand, and two of them made it in within top sixth winning award positions. That really put Shigeru Kawai on the global map — people around the world began to recognize its deep, warm tone and extraordinary expressive capacity. What’s even more impressive is that out of 87 contestants in the first round, only six chose Shigeru Kawai, and half of them made it all the way to the finals. That left a strong impression on the entire piano world.

Figure 1: Finalists of the 2021 International Chopin Piano Competition

(Source: compiled by Hibiki)

(Source: compiled by Hibiki)

Building on that momentum, KAWAI opened a showroom in Warsaw in September 2023, using this Chopin stronghold to educate and inspire pianists across Poland and Europe. This year’s Chopin Competition shows a clear and decisive shift in contestants’ piano selections. Figure 2 compares the results from 2021 and 2025.

Figure 2: Piano Choices of Contestants – 2021 vs. 2025

(Note) C. Bechstein was allowed to re-enter the competition in 2025 for the first time in 50 years.

(Note) C. Bechstein was allowed to re-enter the competition in 2025 for the first time in 50 years.

(Source: Compiled by Hibiki based on information from online sources)

As you can see, Shigeru Kawai exploded onto the scene in this year’s first round — picked by 21 contestants, up from just 6 in 2021, taking its share from 7% to a staggering 25%. While brands like Fazioli held steady, Shigeru Kawai captured a significant portion of Steinway & Sons’ long-standing dominance. Of the 40 contestants who advanced to the second round, 11 chose Shigeru Kawai, underscoring that its beautiful tone will continue to draw global attention.

We believe there are two key factors behind this outstanding result.

First and foremost, the most critical factor is the decades-long dedication and exacting skill of KAWAI’s craftsmen and Master Piano Artisans (MPAs). From carefully sourcing and drying the soundboard, which is crucial for tonal projection, to incorporating carbon fiber components in the action for stability, they have continually refined the piano’s tone, touch, and playability from a uniquely thoughtful perspective. It is this relentless pursuit of excellence that is finally gaining recognition on the global stage.

Equally crucial was expanding recognition. An illustrative moment comes from Piano Forte, a documentary that captures the tension, struggles, effort, and passion behind the scenes of the 2021 competition. In one compelling scene, Eva Gevorgyan, already a world-renowned pianist from Russia/Armenia, is seen testing pianos at the very start of the competition to choose the instrument she will partner with over the coming weeks. After trying instruments from all the manufacturers, she turns to her mentor and says:

“Shigeru Kawai is really amazing — I’d love to play it… but I’ve hardly ever used it before, so I’m not fully comfortable yet. I’m a bit nervous about taking it into a competition where so much is at stake.”

Despite making this comment after considerable inner struggle, she ultimately chose Steinway & Sons. She advanced all the way to the finals but, unfortunately, did not place. This case illustrates a broader point about Shigeru Kawai: a piano that should naturally be the first choice, yet many top contestants hold back, hesitating due to limited exposure and lack of hands-on experience—a clear missed opportunity for recognition despite its superior qualities, underscoring the recognition gap.

Over the past four years leading up to 2025, KAWAI has tackled its second major challenge head-on—expanding recognition and touchpoints—through initiatives such as opening the Warsaw showroom, restructuring its U.S. dealer network, and refreshing its corporate brand. We believe these efforts played a direct role in the remarkable surge in player selection this year. As shareholders, this is truly encouraging. That said, this is still very much just the starting point in our view.

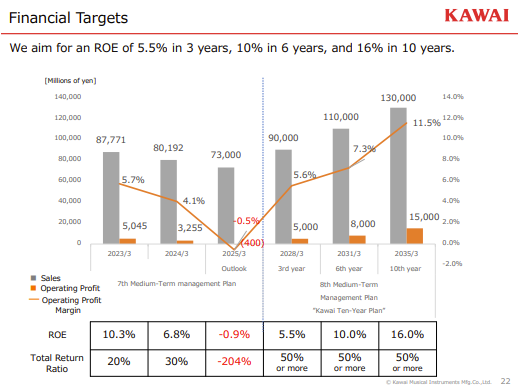

KAWAI is currently executing its long-term management plan, the “KAWAI 10-Year Plan” which runs through 2035. At the heart of this plan is a strategic effort to expand global recognition and market share through digital marketing and proactive brand-building. The company is moving away from the old belief that “good products sell themselves” and instead is committed to actively demonstrating the quality of its products worldwide, increasing consumer touchpoints, and strengthening KAWAI brand awareness. In this context, the company’s strong presence and performance in the Chopin Competition play an extremely important role. Building on this momentum, we look forward to KAWAI not only gaining recognition for its grand pianos but also extending its appeal and consumer choice across digital pianos globally.

Figure 3: Business Performance Targets of the “KAWAI 10-Year Plan”

(Source: KAWAI press release)

Currently, KAWAI’s business performance is still recovering from the post-COVID stagnation in the global instrument market, as well as the sharp contraction in the Chinese market, and unfortunately, the stock price has remained depressed. However, business results have already bottomed out, and the company has laid out an ambitious long-term management plan targeting a 16% ROE by 2035 (Figure 3). From our perspective, it is astonishing that a company bearing a brand recognized by the world’s top players is still valued at only 0.5x P/B in the market. This level, in our candid view, seems too low in order to prevent being targeted by other strategic players.

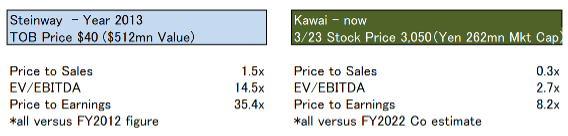

As noted on page 9 of our corporate value enhancement proposal, which we sent on May 8, 2023 and subsequently made publicly available, Steinway & Sons was taken private in 2013 through a purchase of approximately JPY 50 bn, using the personal assets of hedge fund founder Mr. Paulson. At that time, the acquisition price of USD 40.00 per share implied the valuation shown in Figure 4 below, along with a P/B ratio of around 1.8x.

By contrast, KAWAI’s current (as of October 11) valuation, based on Shikiho’s FY27/3 forecasts—which we expect to reflect the end of inventory adjustments and the recovery trajectory becoming visible in the numbers—is 14.6x P/E ratio, 2.3x EV/EBITDA, and a P/B ratio of 0.52x (this on a FY25/3 actual basis). It highlights a staggering gap in market valuation between the two leading piano manufacturers.

Figure 4: Valuation of Steinway & Sons at Privatization vs. KAWAI (At the Time of Recommendation)

(Source: Hibiki Letter, May 8, 2023)

As KAWAI’s reputation among professional pianists continues to surge globally, we expect the brand value of the company to gradually be recognized in the capital markets as well. At the same time, we hope the company’s management actively implements further initiatives to steadily boost the company’s reputation not only within the music industry but also in the capital markets, where investors continue to turn a blind eye. As a minority shareholder, we remain committed to supporting the management in their ongoing transformation while continuing our engagement efforts, including advocacy around brand recognition and financial strategy.

While the young competitors of the Chopin Competition will captivate audiences through to the winners’ gala on October 23, our eyes remain equally fixed on the longer-term trajectory of KAWAI’s “Ten-Year Plan” and the company’s path to global prominence.

(Reference)

31/May/2025 – Discussion on the medium-term management plan with Kawai Musical Instruments Manufacturing Co., Ltd.

23/Mar/2025 – Commentary on Medium-Term Management Plan of Kawai Musical Instruments Mfg. Co., Ltd.

08/May/2023 – Letter to Kawai Musical Instruments Manufacturing Co., Ltd.

This post does not constitute a solicitation for an offer to acquire or recommend the purchase or sale of specific securities, or advice on investment, legal, tax, accounting, or any other matters.