On Aug 7, one of our core portfolio holdings, Mandom Corporation (“the Company”), released its earnings results and held an earnings briefing. Below are our key takeaways and commentary.

Hibiki continues encouragement-type engagement!

We highlight three key points from this quarter’s results.

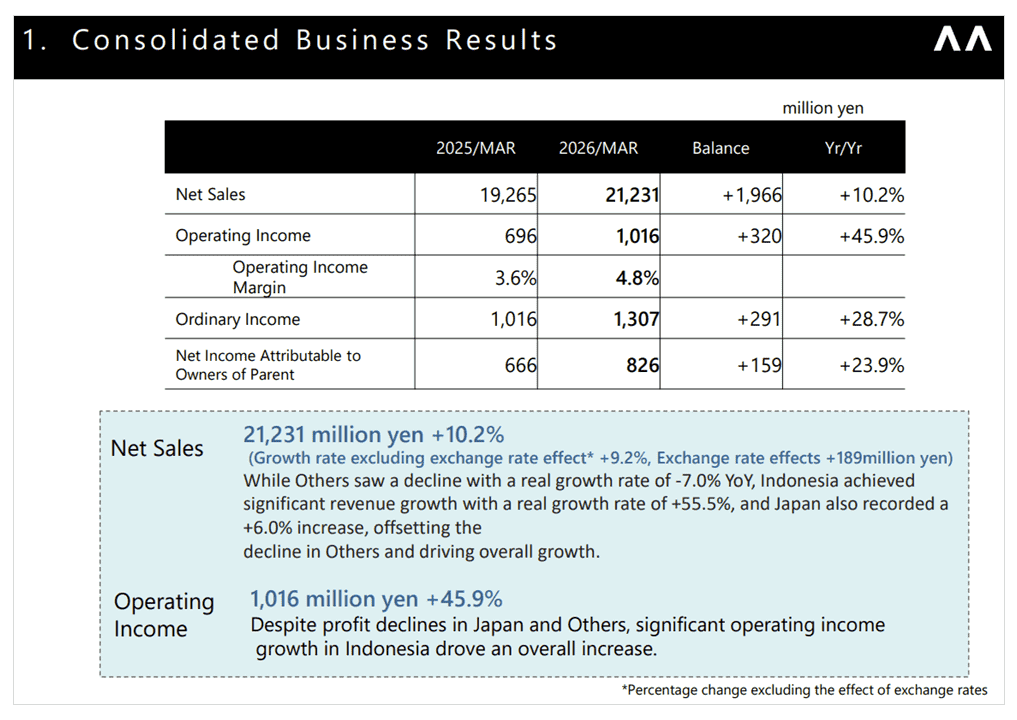

First, the Company’s performance is clearly recovering. As shown in Figure 1, Q1 FY3/26 revenue rose 10% and OP jumped 46% YoY. In Japan, summer seasonal products grew 18.7% YoY, driven by strong promotions including a new advertisement for Roll On. Combined with a sharp V-shaped recovery in Indonesia—which we’ll cover shortly—the Company is making steady progress toward its annual business plan. The new Roll On advertisement is definitely worth watching, as it truly captures the Company’s forward-looking, challenge-driven spirit!

(Source: The company’s earnings presentation materials)

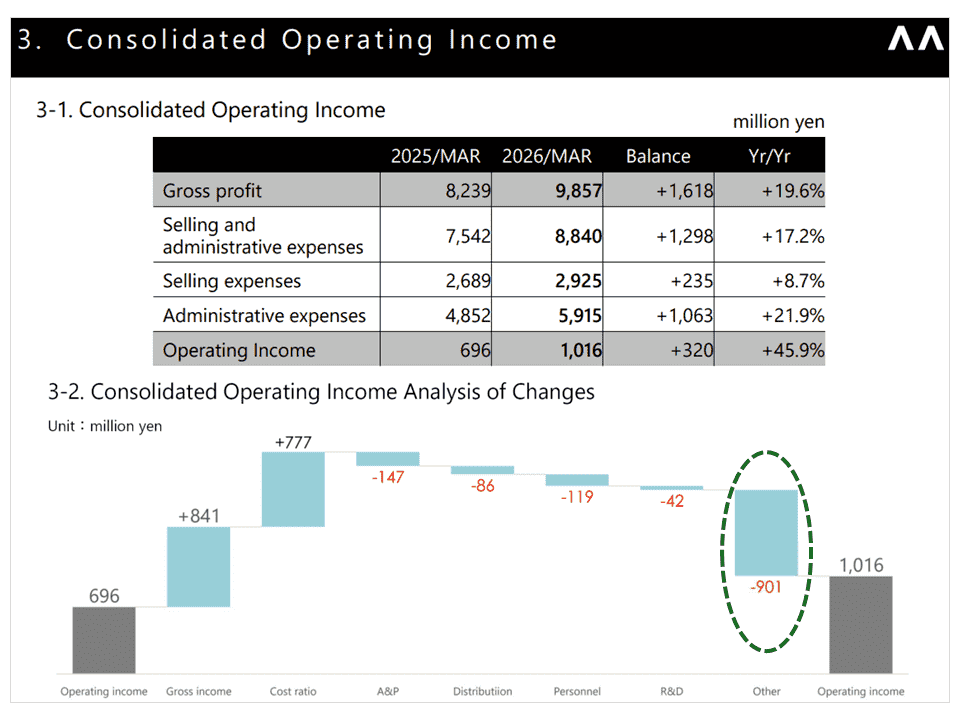

One key point is that the OP improvement includes aggressive restructuring costs. Figure 2’s YoY profit analysis shows that the big boost mainly came from higher sales and price hikes, while restructuring costs of 900mn yen were recorded under “Other.” The company also said that more restructuring costs than expected were pushed into Q1, earlier than originally planned for Q2 and Q3. These costs are mostly domestic and should be fully booked by December this year. So, once these restructuring costs are all accounted for, we expect strong profit growth next fiscal year.

Figure 2:YoY OP analysis of changes

(Source: The company’s earnings presentation materials)

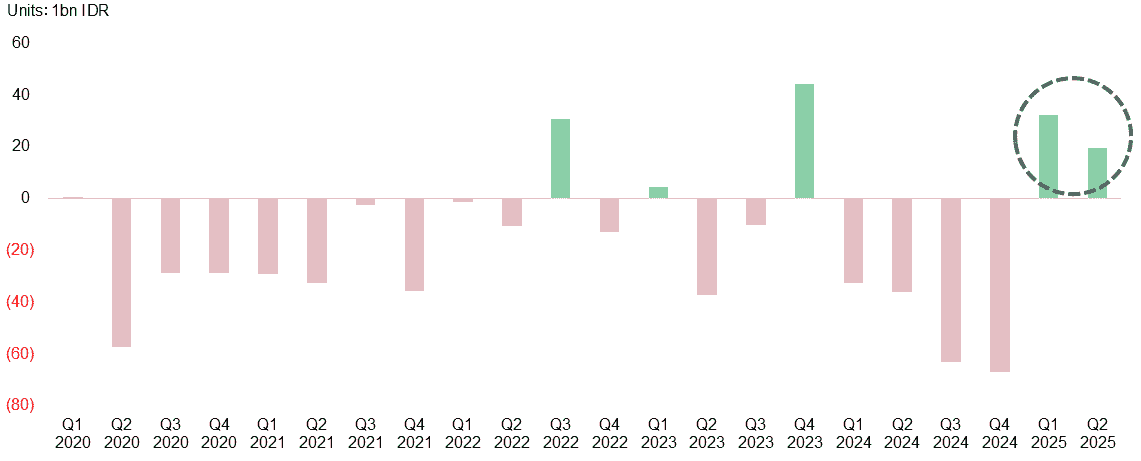

The second point we want to highlight is the sharp V-shaped recovery in the Indonesia business. As we noted in our value enhancement proposal published this April, the Company was an early mover, entering Indonesia back in 1969. Since then, it has steadily built a distribution and logistics network across the many islands that make up the country, and achieved remarkable growth through marketing and product development deeply rooted in local lifestyles. However, the Indonesia business has faced five consecutive years of losses since FY3/21, and the Company has been aggressively implementing sales strategy changes and cost-cutting measures to turn things around.

Amid these circumstances, the Indonesia subsidiary posted OP of 460mn yen¹² in the 1H, marking a significant improvement of +1.14bn yen³ compared to 1H of last year. At the earnings briefing, they mentioned that some advertising expenses planned for the 1H got delayed, so the company now expects to break even for the full fiscal year. Even with the aggressive restructuring costs, they still expect to hit breakeven for the year. This basically means they’re on track to increase OP by +1.8bn yen⁴ YoY. As investors, we truly respect the dedication of management and employees who’ve worked hard to get the business to this point of rapid recovery.

During our last IR meeting, we learned that as part of the restructuring, the company revamped its management team in Indonesia. Under Director Watanabe’s (CEO of PT MANDOM INDONESIA Tbk) leadership, they have been steadily fixing the basics that were previously overlooked, making gradual, step-by-step improvements. We believe these efforts are starting to pay off and show clear signs of a major breakthrough.

Figure 3:OP Trend of the Indonesia Subsidiary

(Source: BBG, PT. MANDOM INDONESIA Tbk Quarterly Report)

Lastly, we’d like to share our thoughts on the need to improve the IR materials. While this was a quarterly earnings release, the disclosure on overseas operations remained limited—a point we regard as a missed opportunity.

Similarly, we get the impression that the Company’s positioning, competitive advantages, and strategies in other overseas regions are not clearly communicated. As a result, it’s challenging for investors to improve their visibility into future performance beyond just looking at quarterly sales fluctuations. To attract more long-term investors, we hope the Company will further enhance disclosure on overseas operations through dedicated briefings and other channels.

Under President Nishimura’s leadership, we sincerely hope the Company will reach a new level of development. As the Company continues to push forward with further reforms, we expect not only the achievement of the 5% ROE target but also the setting and attainment of a more ambitious goal—double-digit ROE—as outlined in our earlier proposal.

We look forward to seeing management, who are leading through these challenging restructuring phases; the employees, who are dedicated to executing these efforts; and the shareholders, who support them behind the scenes—all sharing in the success of enhanced corporate value. Going forward, we intend to maintain our engagement with the company—supportive yet, at times, candid and constructive.

¹ The Indonesia subsidiary is listed locally and has already disclosed its financial results through the quarter following the parent company’s reporting period

² Exchange rate used: IDR/JPY 0.009

³ Comparison to the consolidated Indonesia segment operating loss of 680 million yen in the first half of FY3/25 for Mandom Corporation

⁴ Comparison with the Indonesia segment operating loss in FY3/25

We have taken the utmost care to ensure the accuracy of the data and information contained in this document at the time of its preparation. This post does not constitute a solicitation for an offer to acquire or recommend the purchase or sale of specific securities, or advice on investment, legal, tax, accounting, or any other matters.