In today’s equity market, the rapid expansion of AI data centers has captured intense investor focus, sparking a hunt for companies poised to ride this structural growth wave.

・Nikkei: Data Centre stocks beyond telecommunications: construction, real estate, equipment and maintenance industries (Japanese Only)

・Diamond: Introducing ‘AI Data Center’-related stocks! OpenAI announces plans to build a “gigantic AI data center” in partnership with SoftBank Group and Oracle, as global demand surges (Japanese Only)

・Kabu-Tan:【Special Feature】 The Great Sensation! “AI Data Center Related” Five Hidden Stocks to Watch

Although none of the above articles mention Japan Pure Chemical Co., Ltd. (“JPC” or “the Company”), one of our core portfolio holdings, JPC is also well positioned to benefit from the AI data center theme.

JPC develops and sells gold plating chemicals, and its technological capabilities are unparalleled. For example, in plating solutions used to mount MPUs—the heart of computer servers—to printed wiring boards, JPC held a global market share of approximately 50% in the early 2010s, demonstrating its industry leadership (reference in Japanese only). The company’s website continues to state that it maintains a top-tier global share in plating chemicals for electronic components. However, JPC has historically shown limited focus on enhancing corporate value, particularly in its investor relations efforts. As a result, we have maintained active engagement, including recent commentary on its earnings announcements and on industry consolidation trends

This time, we’re taking a fresh angle to dive into JPC’s optical transceiver business—an area in their portfolio we see as a real hidden gem.

In its FY3/26 Q2 results, the company for the first time publicly identified optical transceivers as one of its growth focus areas. In subsequent IR interviews, JPC explained that these products are mainly used in high-speed communication applications such as generative AI servers. While sales currently represent roughly 10% of the “Plating Chemicals for Printed Wiring Boards and Semiconductor Mounting Substrates” segment (estimated to be around 5% of total revenue based on FY3/26 H1 Report (Japanese Only)), management emphasized that short-term demand is exceptionally strong. If this momentum continues, the optical transceiver business could become a key pillar of the company’s business portfolio.

With a defined strategy for the exploding AI server market and a foundation already in place, JPC is taking a decisive step toward realizing its true corporate value potential.

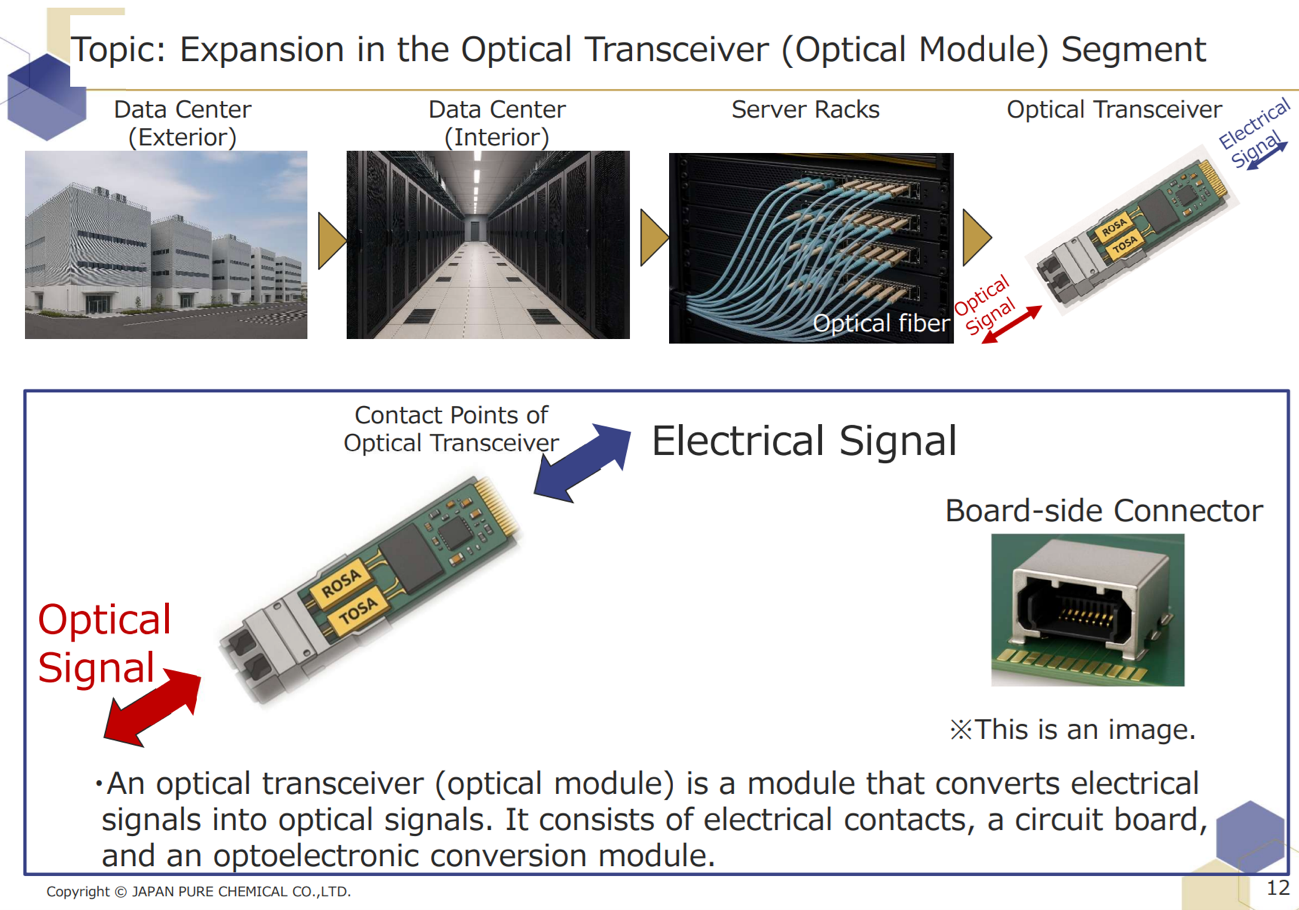

Figure 1: Highlights from JPC’s FY3/26 Q2 Results Presentation — Developments in the Optical Transceiver Business

(Source: FY3/26 H1 briefing materials)

That said, while headlines highlight the rapid adoption of optical transceivers in AI servers, it’s still challenging to gauge the full scale of the opportunity from JPC’s disclosures alone. The more we looked into it, the stronger our conviction became that this segment could evolve into one of the company’s core businesses. Thus, we would like to share our perspective with fellow investors and, to that end, propose examining the topic in greater depth from the following angles:

- What are optical transceivers used for?

- How much growth can we expect from this business area moving forward?

- Why does gold plating play an important role in this space?

~~~~~

- What are optical transceivers used for?

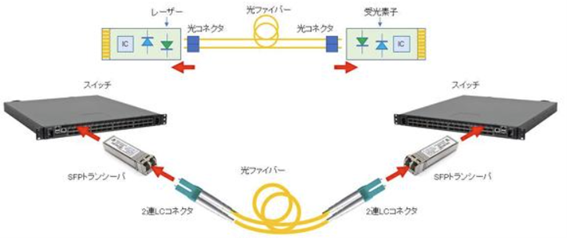

Optical transceivers are devices that convert electrical signals into optical signals and vice versa, serving as a critical foundation for today’s high-speed optical-fiber communication networks (reference). As shown in Fig. 2, they are positioned at the interface where optical fibers connect with network equipment. Large-capacity data transmission requires both transmission speed and minimal loss, and thus is performed over wired connections rather than wireless methods such as Wi-Fi.

Figure 2: Parts in which optical transceivers are used

(Source: EE Times Japan (Japanese Only))

We regard optical transceivers and optical fibers as indispensable components of AI data centers, as they directly address the three core challenges AI data centers face: long-distance data transmission, high-speed and efficient communication, and reduced power consumption.

AI data centers tend to be geographically distributed, making high-speed, long-distance data exchange essential. At the same time, AI servers generate substantial heat, so minimizing power loss and easing the burden on cooling systems are critical priorities. Moreover, projections suggest that by 2030, electricity consumption by data centers could exceed Japan’s current total domestic power usage, underscoring the urgency of energy efficiency. (reference 1 (Japanese only),reference 2)

Optical transceivers and fibers are the key solutions to these challenges. Compared with copper cables, optical fiber communication delivers much higher speeds and dramatically lower signal loss, enabling efficient long-distance transmission while minimizing power waste and saving energy. Within this system, the transceiver—responsible for converting electrical signals to optical signals and vice versa—plays a critical role in determining overall communication performance. (reference)

Indeed, Japan’s major optical-fiber manufacturers, Furukawa Electric (5801), Sumitomo Electric (5802), and Fujikura (5803), often referred to as the “electric-wire Big Three”, have seen their share prices surge in 2024-2025 amid mounting expectations for this growth field. Year-to-date performance for all three companies has been remarkable; notably, Fujikura ranked #1 among TSE Prime companies in share-price performance for 2024 (Japanese only), continuing its strong upward trajectory.

Figure 3: Electric-Wire Big Three’s Percentage Change in Price

(Source: Shikiho Online, Kabutan)

As the optical-fiber market expands, the connector market, including optical transceivers, is expected to grow in tandem. For example, Suncall (5985), a manufacturer of connectors and adapters, revised its earnings forecast sharply upward (Japanese only) in August 2025 due to stronger data-center-related demand; its share price rose approximately +264% from JPY 278 at the end of 2024 to JPY 1,012 at the end of October 2025. Similarly, Seikoh Giken (6834) soared nearly +600%, from JPY 1,380 at the end of 2023 to JPY 9,600 at the end of October 2025 and gained a further +20% following the release of its Q2 results on November 13.

What stands out in the case of Seikoh Giken is that its share price movement in 2024 anticipated the company’s future performance. The full-year results for FY3/24, announced in May of that year, showed a decline in revenue from the previous year and the lowest operating profit in the past five years. However, as profits came in above expectations and management presented a bullish outlook for its optical products division centered on optical connectors in the earnings presentation materials, investor expectations for a turnaround grew rapidly, driving a significant rise in the share price. In reality, in FY3/25 the company’s sales rebounded from JPY 15.8 bn to JPY 20.0 bn, and operating profit surged from JPY 1.1 bn to JPY 2.8 bn, achieving a clear V-shaped recovery that validated the market’s earlier optimism. This is a textbook example of how, in rapidly expanding fields, investors who recognize latent potential ahead of visible earnings growth can reap the rewards once that growth materializes.

Given the robust growth in both the optical fiber and connector markets, it’s only natural to expect that the optical transceiver market—where JPC provides its plating chemicals—will expand alongside them. We look forward to JPC steadily securing new projects and fully capitalizing on this powerful growth wave.

It should be noted that, as a manufacturer of plating chemicals used for substrate surface treatment, JPC has not been able to fully benefit from the recent trend toward multilayer substrates. Consequently, despite the robust conditions in the semiconductor industry, the company’s growth has lagged behind in recent years. However, in the case of optical transceivers, each AI server requires a large number of individual units, meaning that growth in this field directly translates into higher sales volumes for JPC. We therefore view this as a rare and significant business opportunity that could serve as a key driver of earnings expansion.

2. How much growth can we expect from this business area moving forward?

Research firms project a very positive outlook for the optical transceiver market. According to Global Information, Inc., the global optical transceiver market is estimated at USD 13.6 bn in 2024, and is expected to reach USD 25.0 bn by 2029, representing a compound annual growth rate (CAGR) of 13.0% between 2024 and 2029.

Furthermore, the same firm’s report on AI servers forecasts an exceptionally strong growth trajectory, with the global market projected to expand at a CAGR of approximately 18.7% through 2030.

Behind this trend lies the global race to secure computing resources¹ essential for AI processing. The supply of computational infrastructure has not been able to keep pace with the surging demand for AI utilization, creating a major bottleneck in the industry’s development. To address this, Sam Altman of OpenAI has stated (CNBC) that he envisions multi-trillion-dollar investments in data centers. Microsoft has signed a USD 9.7 bn agreement with data center operator IREN (Reuters), while Bloomberg recently reported that Google plans to invest USD 40 bn in a data center in Texas. In Japan as well, Microsoft, AWS, and Google are each planning major data center investments of JPY 440 bn, JPY 2.2 tn, and JPY 100 bn, respectively (METI (Japanese only)). A series of such announcements and high-profile commitments clearly illustrates the intensifying competition to secure computing capacity.

The above-mentioned METI report explicitly states that “the competitiveness of generative AI depends not only on “AI’s functionality” but also on the ability to “minimize power consumption”, which is imperative in controlling the ever-increasing computational demand.” We therefore believe that the optical transceiver market, which plays a critical role in achieving this, has substantial growth potential, and will, in turn, have a positive impact on JPC’s earnings, as the company supplies the plating chemicals used in these transceivers.

3. Why does gold plating play an important role in this space?

First, let us examine where gold plating is used within an optical transceiver. While plating is applied to various components, the core area is the printed circuit board (PCB)—the green board-like structure that forms the electronic circuitry. PCBs are indispensable in modern electronics manufacturing, and optical transceivers are no exception (reference). In fact, JPC has indicated that its plating chemicals for optical transceiver applications are primarily supplied to PCB manufacturers.

JPC’s specialty gold-plating solutions are used in the plating processes of the connection interfaces, which are critical for ensuring the qualities most demanded in optical transceivers: low power consumption and high computational efficiency. Owing to gold’s intrinsic properties, (a) high electrical conductivity and (b) excellent corrosion resistance, these applications are difficult to substitute with alternative plating materials.

Let us first consider point (a). As the term “electrical conductivity” suggests, this refers to how easily electricity passes through a material. As noted earlier, energy efficiency is a critical requirement for AI data centers, and optical transceivers are no exception. Devices that transmit electrical signals with minimal energy loss are essential.

Among the components of optical transceivers, laser diodes are particularly sensitive to heat; it is said that a temperature increase of just 10℃ can cut their lifespan in half (reference (Japanese only)). The lower the electrical conductivity (i.e., the higher the resistance), the more signal energy is converted into heat, which reduces transmission efficiency and increases power consumption. Gold ranks third among major metals in electrical conductivity, behind only silver and copper, and thus contributes towards the improvement of the optical transceivers’ quality (reference).

“While silver and copper plating exceed gold in terms of pure electrical conductivity, it is gold’s superior (b) corrosion resistance that ultimately gives it a decisive advantage. Corrosion resistance refers to a metal’s ability to withstand deterioration over time. As metals age, they oxidize and form oxide films (rust being one example), which degrade electrical conductivity and shorten product lifespan. Gold, by contrast, is exceptionally stable and highly resistant to oxidation and corrosion, enabling long-term, reliable performance. This unique combination of high electrical conductivity and corrosion resistance is precisely why gold plating remains the overwhelmingly preferred option over alternative materials.

Data centers, by their very nature, require uninterrupted long-term operation. According to a NUTANIX article, up to 37% of a company’s profitability can be lost due to IT downtime, highlighting how critical stable infrastructure has become to modern business operations. For data center operators, even a slight compromise in reliability could mean the loss of major business opportunities. Therefore, there is little incentive to adopt cheaper substitute plating materials that carry operational risk. Although gold prices have trended upward in recent years, gold’s share of the total procurement cost of an optical transceiver is presumed to be relatively small.

With the above in mind, we believe that the technological superiority of gold plating, where JPC holds a strong competitive edge, is highly durable, and that the growing number of AI servers and optical transceivers will serve as a powerful tailwind for JPC’s future growth.

In conclusion, the above outlines why we regard JPC as a “hidden AI-related stock.” The analysis presented here reflects our investor-oriented perspective, supported by available data and references. We encourage readers to explore the topic further, as there may well be additional insights to be uncovered.

While every effort has been made to ensure accuracy, the content herein is not guaranteed and is provided solely for informational purposes.

~~~~~

In preparing this report, we also made extensive use of generative AI to research market and technology trends. Across a wide range of sectors, it is becoming increasingly clear that operations can no longer be managed efficiently without the support of generative AI, and few would question its value today. At the same time, however, mass adoption of AI—including physical AI—has only just begun.

Amid this profound transformation of industrial structure—an AI revolution reshaping not only entire industries but also our daily lives—the need for high-speed, high-volume data transmission and superior electrical conductivity has become one of the most urgent and critical challenges. In this context, the gold-plating technology developed by the Company stands out as an indispensable enabler of such performance.

In our previous commentary, we noted that the functional chemicals sector for semiconductors faces both significant opportunity and existential challenge, and that companies must boldly pursue structural alliances and break free from legacy constraints. The surge in computing-resource demand driven by generative AI lies squarely at the center of this opportunity. We therefore hope to see the Company secure a strong foothold in this field and, above all, present strategic management options that genuinely enhance corporate value, allowing this highly promising business to fully realize its potential.

¹ The term refers broadly to the infrastructure necessary for computational processing, including data centers as a key component. While there is no strict definition, materials from Japan’s Ministry of Economy, Trade and Industry (METI) describe it as “AI data centers and management systems,” whereas the Ministry of Internal Affairs and Communications (MIC) refers to it as “computational resources such as data centers.” In this discussion, the term is used in practice to refer specifically to data centers.

(List of past posts related to engagement with JPC)

List of Posts

27/Oct/2025 – Connecting JPC’s Q2 Performance with Trends in the Semiconductor-Related Functional Chemicals Industry

30/Jul/2025 ー JPC: Revised Large Shareholding Report

7/Jul/2025 – Reflections on the Fuji Media Holdings Governance Review and Its Implications for Japan Pure Chemical Co., Ltd. (Japanese Only)

27/Jun/2025 — Results of JPC’s 54th Annual General Meeting of Shareholders (comment on voting results)

23/Jun/2025 ー JPC’s 54th Annual General Meeting of Shareholders

16/Jun/2025 – Appointment of an Inspector for the 54th Annual General Meeting of JAPAN PURE CHEMICAL CO., LTD.

11/Jun/2025 – Hibiki Path Advisors finalized Its Policy for the 54th Annual General Meeting of JAPAN PURE CHEMICAL CO., LTD.

7/Jun/2025 – ISS Endorses Hibiki’s Shareholder Proposals to JAPAN PURE CHEMICAL CO., LTD.

4/Jun/2025 – Connecting the developments surrounding TAIYO HOLDINGS with our campaign against JAPAN PURE CHEMICAL CO., LTD.

1/Jun/2025 – Regarding the Public Campaign as the largest Shareholder of JAPAN PURE CHEMICAL CO., LTD.

28/May/2025 ー Publication on DIAMOND online regarding JPC campaign

26/May/2025 ー As the largest shareholder of JAPAN PURE CHEMICAL CO., LTD., requested the Outside Directors to provide their thoughts regarding Hibiki’s opinion

22/May/2025 – Commentary of the shareholder proposal to JAPAN PURE CHEMICAL CO., LTD.

21/May/2025 – Submission of a shareholder proposal to JAPAN PURE CHEMICAL CO., LTD. as its largest shareholder

2/Oct/2024 ー About Letter to the board of directors in Japan Pure Chemical Co., Ltd.

This post does not constitute a solicitation for an offer to acquire or recommend the purchase or sale of specific securities, or advice on investment, legal, tax, accounting, or any other matters. In the event of any discrepancy or conflict between the English and Japanese versions, unless otherwise noted, the meaning of the Japanese language version shall prevail unless otherwise expressly indicated.