Dear Investors, we extend our best wishes for the new year and sincerely thank you for your continued support. For our first post of the year, we are pleased to feature one of our longstanding investees.

On January 14, 2025, Star Mica Holdings Co., Ltd. (hereinafter referred to as “Star Mica” or “the company”), a key investee within our portfolio specializing in real estate vitalization investment, held its financial results announcement and earnings presentation. Star Mica is a rare case among Japanese firms, demonstrating sustained growth while maintaining a robust ROE of approximately 15%, supported by reasonable leverage on B/S. However, despite its strong performance, the company has struggled to gain recognition in the capital markets, with its P/E ratio remaining in the single digits and its P/B ratio fluctuating around 1x.

We have been in ongoing dialogue and engagement with the management of Star Mica over the years. However, recent developments strongly conveyed the company’s renewed and unprecedented determination to engage with the market and pursue growth as a listed company. In light of such shift in gear, we would like to take this opportunity to highlight their commitment.

The key highlights of this financial results announcement are twofold: (1) the upward revision of the company’s mid-term plan and (2) a significant shift in the company’s disclosure approach, which effectively conveys the scale and impact of (1).

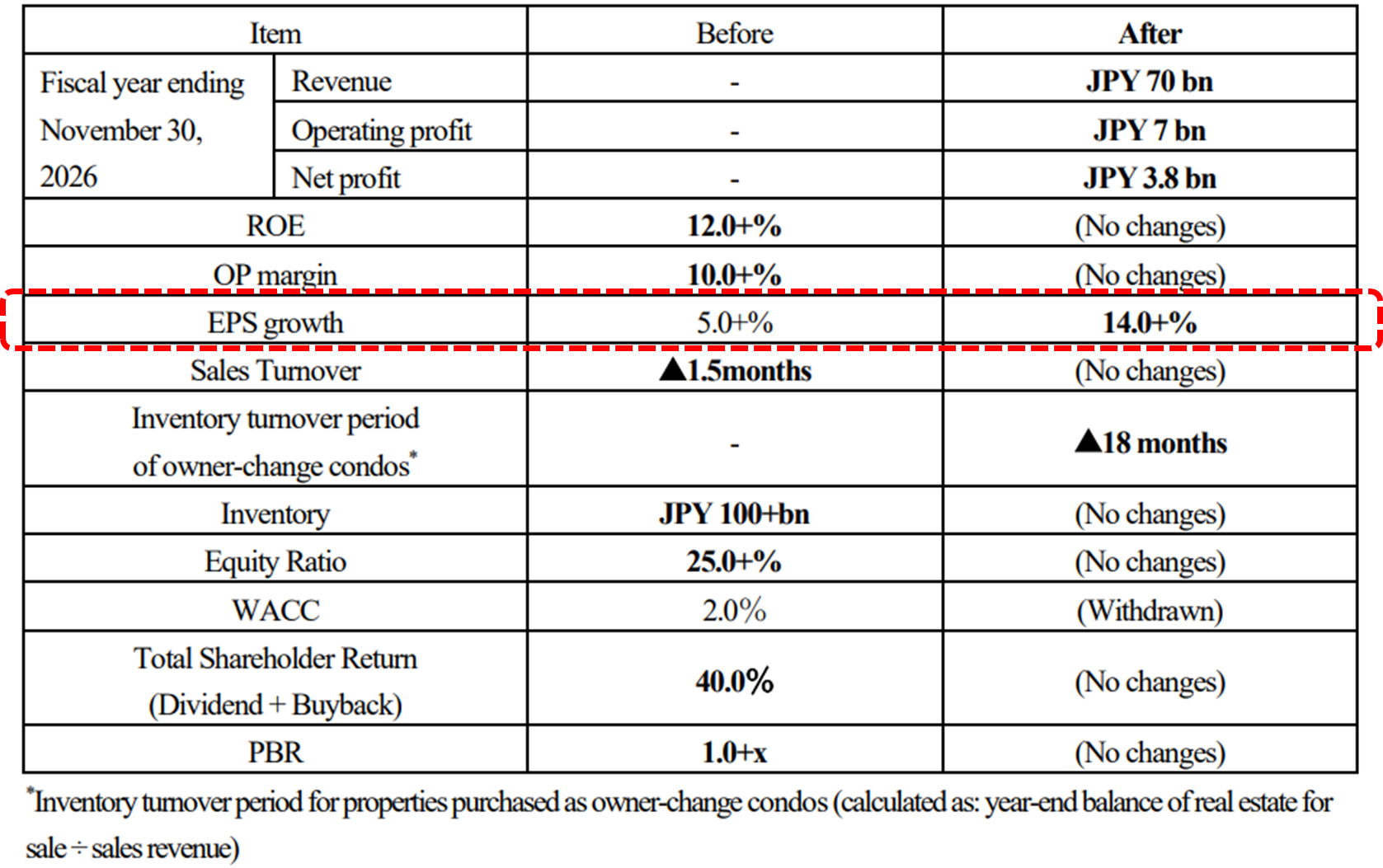

The upward revision of the mid-term plan encompasses various aspects, but we would like to highlight two key points here. First, as illustrated in Figure 1 below, the company has disclosed quantitative targets for revenue and profit. Specifically, as shown in the table, the targets for FY2026/11 include revenue of 70-billion-yen, operating profit of 7 billion yen, and net income of 3.8 billion yen.

Figure1: Revised Items in the Starmica’s Mid-Term Plan (quantitative goals)

(Source: Excerpt from the “Notice of Revision of Starmica’s Mid-Term Plan“)

The company recognizes that the real estate market operates cyclically and is heavily influenced by interest rate trends. For this reason, after careful consideration, the initial mid-term plan released in January 2024 deliberately refrained from disclosing quantitative goals. However, the decision to now release these targets, even in a manner that may appear abrupt, reflects the company’s confidence and determination. In an environment where many firms lack the courage to revise once-announced plans despite VUCA circumstances, this proactive announcement is a testament to the company’s forward-looking stance.

Star Mica’s real estate renovation business has long been considered a niche within the broader real estate industry. In our open letter we sent to the company in November 2022 (Japanese Only), we described Star Mica’s business within this context, positioning it as part of an even more specialized subsector within the emerging real estate industry. Upon reviewing the company’s quantitative goals, we have observed its growing confidence as a core real estate platformer. This confidence is evident in its consistent ability to rotate acquisitions and sales. By doing so, Star Mica ensures stable business expansion while contributing to society amid demographic decline, an aging population, and the push for sustainability. Assuming the company achieves its FY11/26 net income target of 3.8 billion yen, its current market capitalization of 25.4 billion yen results in an implied P/E ratio of 6.7x. For a company that plays a vital role in supporting a sustainable society and is poised for double-digit EPS growth, it is surprising that its valuation remains less than half of the forecasted 15x PER for the Topix, a key indicator of Japan’s economy. We believe we are not alone in questioning this disparity.

The second key point in the upward revision of the mid-term management plan is the EPS growth rate, highlighted in red in Figure 1. In the initial mid-term plan, the EPS growth rate was projected to be “over 5%” which was just too modest considering its past trach record; however, it has since been revised upward to surpass 14%, nearly three times the original estimate.

Based on our extensive experience, it is regrettable that the profit targets set by many companies are often unreliable. However, we were genuinely impressed by Star Mica’s recent shift. In its initial mid-plan, Star Mica refrained from disclosing numerical targets under its “serious” and “conservative” philosophy, committing only to achievable figures. However, the company has now decisively presented ambitious objectives, not only in terms of “profit levels” but also in “EPS growth,” an index that inherently reflects the concept of the number of shares. It is commendable that Star Mica boldly sets ambitious targets even by significantly altering its original position. If this represents the company’s thoughtful response to investor concerns, including our discussions and a renewed recognition of its own pride as a “first-class publicly listed company,” we view this as a highly commendable development deserving of recognition.

The second point is about the disclosure approach, which we, in fact, see as an even more significant shift for Star Mica.

We would like to provide an explanation aligned with the new disclosures presented in the materials from this earning call. Please note that our interpretations of these new disclosures are subjective, and we kindly ask for your understanding in this regard. For official clarifications, we encourage you to reach out directly to the company. There are three primary points of significance to address regarding this matter.

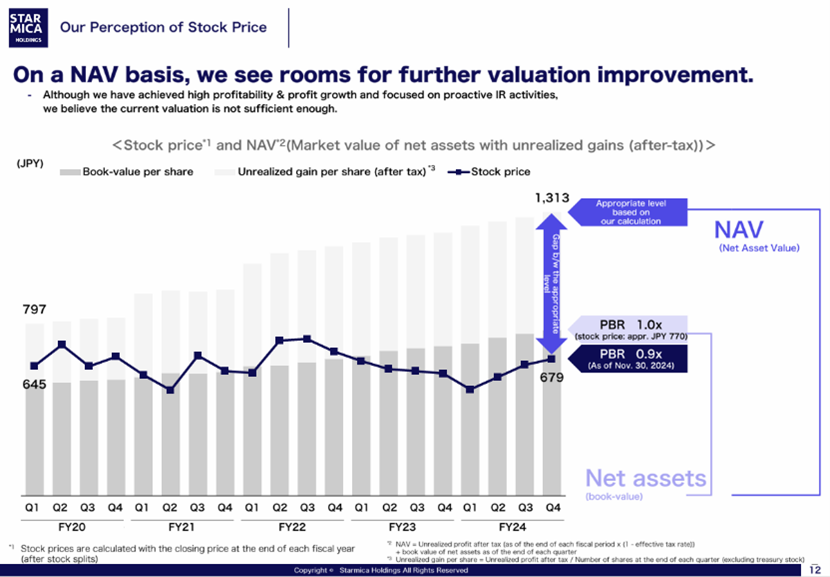

The first key point concerns pages 12 and 13 of the FY 2024 Financial results presentation materials (Figures 2 and 3).

Figure 2: The Company’s Perception of Stock Price

(Source: Excerpt from page 12 of Star Mica’s FY2024 Financial Results Presentation Materials)

A key issue we have consistently raised with the company’s management during our engagements is the need for a discussion on “per-share metrics that reflect the overall state of the company.” It is commendable that, as of FY2024, the company has reported unrealized gains of 26.8 billion yen based on “kantei” property appraisals[1], a figure that can be considered conservative by industry standards. However, for smaller shareholders such as Hibiki, it is not readily apparent how much of the 26.8 billion yen belongs to each individual shareholder without technical calculations. However, now, under figure 2, we clearly can see the maths. Its Book-value per Share is 768yen and with the added unrealized gain (post tax) its NAV per share becomes 1,313yen! Shareholders can acquire shares with over 500 yen of unrealized post-tax gains, combined with the growth potential of the underlying business, at a price of 749 yen (the closing price as of January 14, 2025). This undeniable fact raises a critical question of whether this reflects a significant undervaluation. We feel there is great significance in the company itself continuing to pose this question to the investors by now clearly addressing it in this chart.

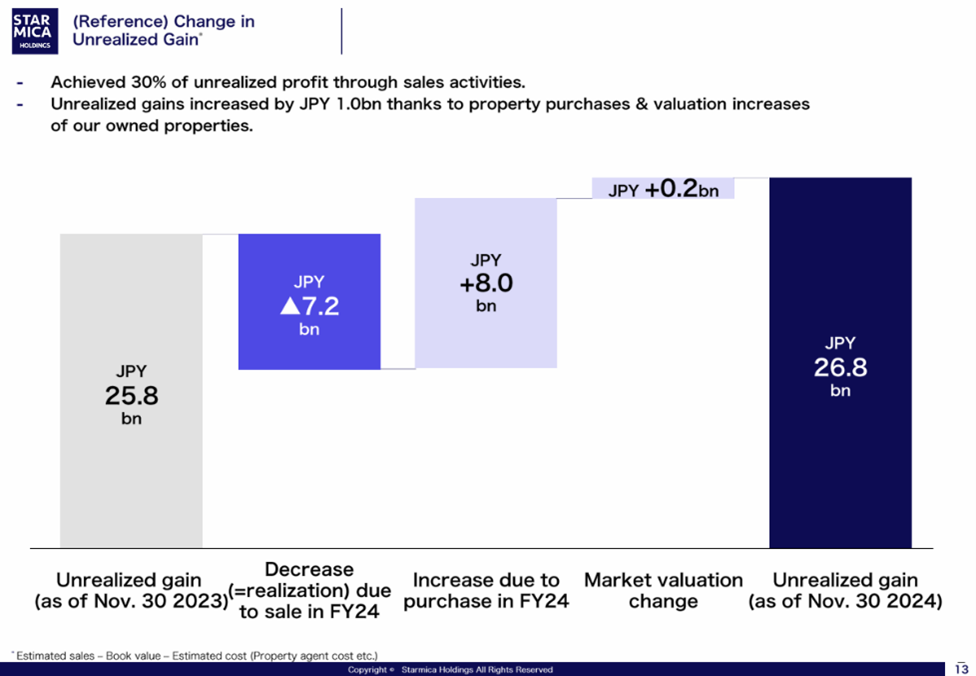

Figure 3: (Reference) Changes in Unrealized Gain

(Source: Excerpt from page 13 of Star Mica’s FY2024 Financial Results Presentation Materials)

One of the additional points we have been mentioning to the management of Star Mica is to boldly convey its unique business model that “consistently realize the unrealized gain on Balance Sheet” for the benefit of shareholders. Unlike large developers that hold prime real estate acquired over a century ago with no intention of selling, and whose unrealized gains remain merely theoretical, the company’s business model is distinct. It revolves around purchasing, renovating, and selling condominiums, making realizing unrealized gains a core element of its operations. In recent years, Star Mica has been selling and purchasing over 1,000 units annually from its inventory of approximately 4,000 units, creating a continuous and steady turnover akin to a flowing stream. Still, from an external perspective, it has been unclear to what extent these unrealized gains are consistently realized, leaving investors, including ourselves, with a certain degree of uncertainty. However, this issue has been resolved with the disclosure presented in Figure 3 on page 13 of Star Mica’s FY2024 Financial Results Presentation Materials.

The section labeled “Decrease (=realization) due to sale in FY24” in Figure 3, amounting to approximately 7.2 billion yen, represents the realization of unrealized gains through selling existing properties. This corresponds to approximately 28% (=7.2/25.8) of the unrealized gains from the previous fiscal year being converted into actual “cash” profits for shareholders. In previous disclosures, only gross figures, such as the unrealized gains increasing from 25.8 billion yen to 26.8 billion yen from the previous fiscal year to the current one, were presented. This could give the impression that unrealized gains were merely increasing without being realized. However, the current disclosure highlights the fact that unrealized gains from existing properties are being realized through sales and are serving as a resource for shareholder returns. We believe this new disclosure carries significant value in clearly communicating this fact to the market.

By examining the steadily increasing per-share NAV shown in Figure 2 alongside Figure 3, it becomes evident that Star Mica’s business model not only involves the ownership of high-quality rental properties but also incorporates the consistent realization of unrealized gains from those properties, thereby delivering returns to shareholders. We believe that this level of disclosure will enhance investors’ understanding of Star Mica’s distinctive business model within the real estate sector. Such improved understanding is anticipated to lower its risk premium and bring the P/E multiple closer to a level that reflects its growth potential.

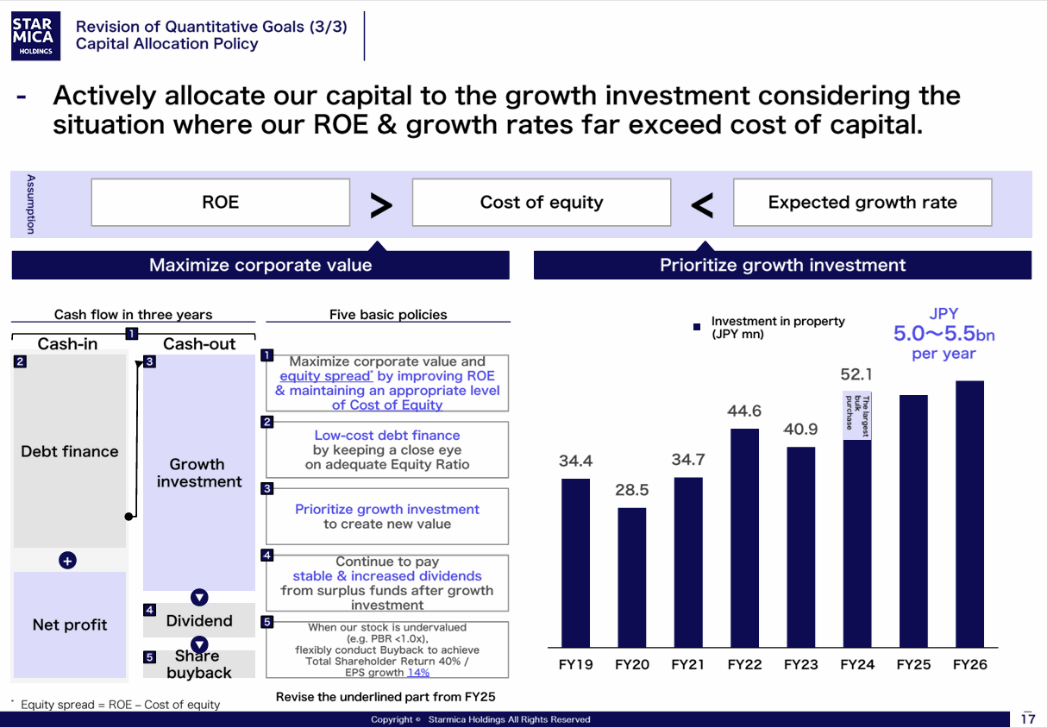

The second key point is regarding page 17 of the presentation material, as illustrated in Figure 4.

Figure 4: Revision of Quantitative Goals (3/3) – Capital Allocation Policy

(Source: Excerpt from page 17 of Star Mica’s FY2024 Financial Results Presentation Materials)

One notable change from the previous presentation materials is the inclusion of a “growth investment amount of approximately 50 to 55 billion yen per year.” Previous disclosures had primarily indicated that cash allocation would be largely directed toward growth investments without providing specific details. However, the company’s recent disclosure of specific figures for growth investments, including future property acquisitions, now allows shareholders to estimate the balance between growth investments and shareholder returns, a clarity that was previously unavailable. We believe this aspect will also contribute to a reduction in its risk premium.

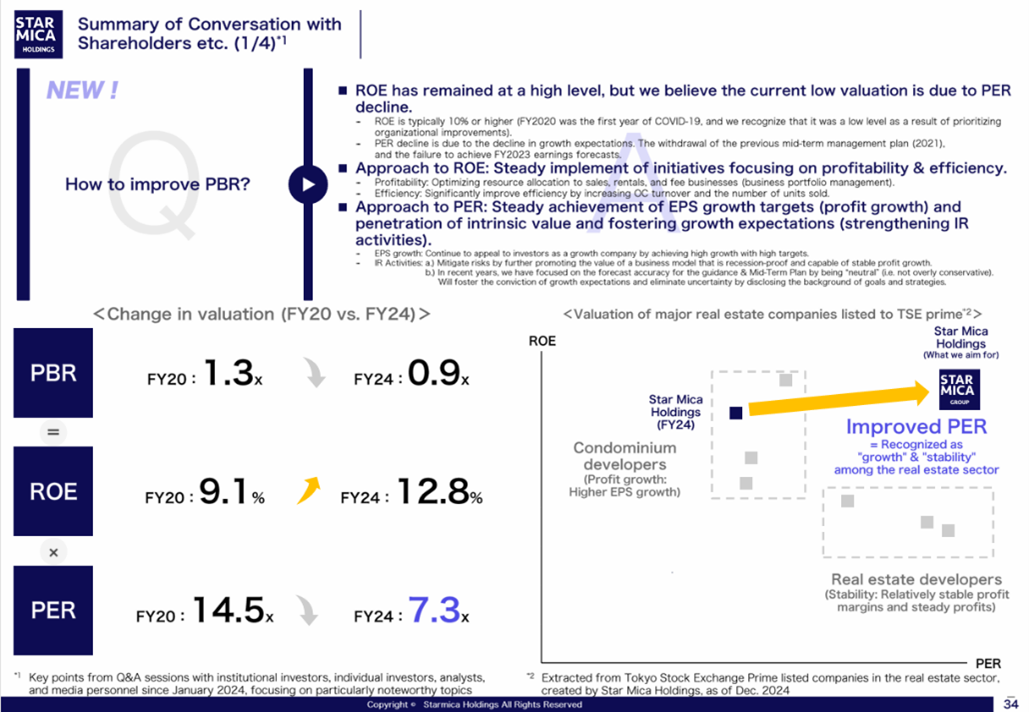

Finally, the third key point pertains to page 34 (Figure 5).

Figure 5: Summary of Conversation with Shareholders etc. (1/4)

(Source: Excerpt from page 34 of Star Mica’s FY2024 Financial Results Presentation Materials)

This page reflects the company’s sincere acknowledgment of the challenge posed by the significant decline in its P/E multiple. Building on this, the proactive approach to addressing the issue of its P/B falling below 1.0x appears highly logical. By leveraging the formula P/B = ROE × P/E, and given that the company has already achieved a high ROE, the focus on attaining a higher P/E valuation is a rational strategy.

We believe that by presenting the future growth potential for Star Mica clearly and without being overly conservative, through “sustainable growth in stable earnings (EPS)” and “proactive IR activities to appeal to investors,” the current undervaluation of its stock price can be recognized and resolved, ultimately leading to a higher P/E valuation. Additionally, the pre-owned condominium development industry, to which Star Mica belongs, benefits from robust fundamentals. This is driven by increasing demand for pre-owned condominiums in urban areas, spurred by demographic decline, population aging, and rising construction costs for new condominiums. We deeply resonate with the company’s stance of engaging with investors, by suggesting that it would not be unreasonable for a business with a rare model that holds substantial unrealized gains and continuously cycles and realizes them without stagnation to be valued with a higher P/E.

We remain committed to enthusiastically supporting the continued growth of Star Mica.

[1] The balance of the real estate for sale as of the FY 11/2024 is 95.8 billion yen, accounting for 28% unrealized gain ratio.

While every effort has been made to ensure the accuracy of the data and information contained in this post, the accuracy cannot be guaranteed. This post does not constitute a solicitation to subscribe for, or a recommendation to buy or sell, any specific securities, nor does it constitute investment, legal, tax, accounting, or other advice.