Why Pay Attention to the Stock Price

|

Today, I would like to share my personal thoughts about something that executives of many listed companies are pondering in your hearts on a regular basis. I think that many of you have conducted your own surveys, thought about it, and accepted it, but through your words, feel that you are truly feeling that you the answer you have come up is not completely convincing. I don’t know if my interpretation will resolve the issue, but today, I would like to at least put forth something that have been accepted by several proprietors of listed companies whom I respect, and to be more accurate, something that is said to be already known as an obvious thing without the need to be told.

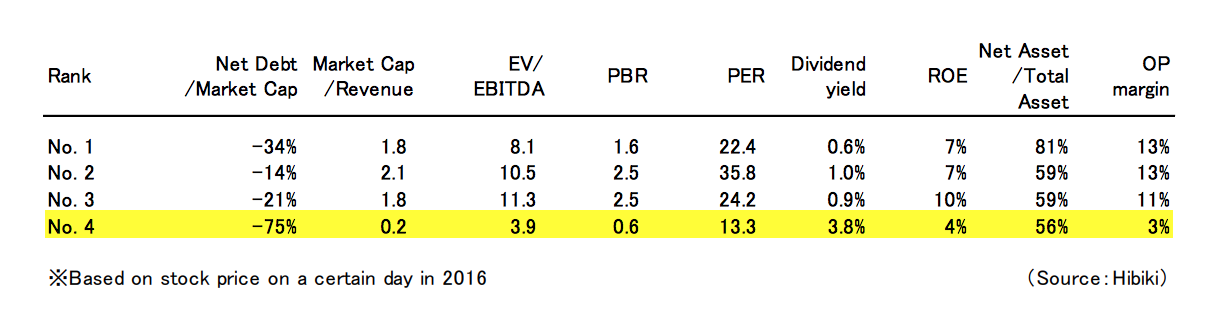

First, there’s this: Don’t you all feel, and I feel it too, that there is almost no correlation between daily stock price movements and corporate value? I really feel that’s the case. Stock prices not only measure the temperature of the economy in general, but they also measure the economy’s blood pressure and pulse to find out its emotional state, so stock prices’ daily movements are a reaction to various external factors. Mental factors exert a lot of influence too. To be sure, although most stock price movements are in response to earnings revisions or other major news released by any given company, even these are examples of the eminent economist John Maynard Keynes’s statement that stock prices are akin to votes in a beauty contest. For example, if a certain company’s stock price goes up 5% the day after it revises its earnings, that does not mean that its corporate value has increased by 5%. It only means that buying and selling among market participants was brought into equilibrium, nothing more and nothing less. One famous equity investor in the U.S. said, “Corporate value is like watching grass grow. Even if you watch it every day, you have no idea how much it has grown.” Naturally, many things happen at the company every day, and without a doubt these occurrences are very trying. However, the value of an entire corporation does not change very suddenly, except in such cases as a major merger or acquisition. Even so, I would like to give two reasons why management needs to pay attention to the stock price anyway. First, please look at the table below. This is a simple comparison of the stock valuations and financials of relatively stable companies ranked first through fourth in a certain industry. This industry is an oligopoly in which the top four companies already have at least 50% of the market share. The business climate is such that it is easy to earn excess profits.

What you will soon notice is that the fourth largest company has a very low stock valuation. Although the company is not losing money, its price/book ratio (PBR) is 0.6 times, and its market capitalization is only 0.2 times its revenue. Of course, we see that its profitability is apparently low, and its market share is significantly lower than those of the majors, so it has no price-leading capability and is instead relegated to being a price-taker. Yet still, it seems that the difference in its stock valuation vis-a-vis its peers is much too large. So, in my opinion, this is the first reason we should pay attention to stock prices: so that we can avoid a situation in which the tail is wagging the dog. In other words, even though everything is fine (right now, I can’t see anything wrong with this fourth-place company; in fact, it possesses many aspects that could lead to improved profitability – and potentially a much higher stock price based on such positive developments), if the company has the misfortune of undergoing various challenges that cause its stock price to stagnate, the stock price itself would start sending its own signals in a derogatory sense of “there should be something really bad about this company, since its stock price looks so cheap just seen on surface.” It seems to me that once this happens, a vicious circle will ensue, so that it will usually be extremely difficult for the company to extricate itself from such a stock valuation. Of course, from the perspective of investors like myself, the stock price of this fourth-ranked company is very cheap, so it looks interesting, but as there are more than 3,000 companies listed on the exchange in Japan (and Japan does not look like a structurally growing economy), unless it attracts attraction to some degree, it would be likely to be put into a corner and easily be ignored from the market for several years. Not being recognized for any achievements is a cruel way to treat corporate management, isn’t it? So, in the sense of at least making sure that one’s own company’s stock price is not treated in such a way vis-a-vis those if its peers, watching and re-examining from time-to-time the company’s stock price are an extremely critical exercise. On the same note, but in fact on the contrary, we can get many ideas about analyzing stock valuations by looking at how rival companies with higher stock valuations differ from one’s own company, and conducting a comparative financial analysis to find out how to close the valuation gap. In this specific example put forth above, there are also economies of scale, and there is a distinct gap in operating profitability between the number-four company and those ranked above it. In other words, if we believe that this is part of the reason for the difference in the stock valuation, improving operating profitability will naturally lead to a higher stock price valuation. Also, because the price/earnings ratio (PER) is already so much lower than those of peers, rise of the PER level itself (for example, from 13 times to 20 times) by improving the company’s financial metrics could be possible (if profit doubles and the PER goes from 13 times to 20 times, the stock price will triple). Hints on what to do when comparing the company with its peers can be gleaned by looking at the stock price situation. The second reason is that, unlike the above case in which the company was put in a corner and ignored by the market for over several years, some may consider it unnecessary to worry about the company because it is not going bankrupt and is not in a crisis. However, that cannot be said. This is because, compared with the higher-ranked companies, the fourth-ranked company has an extremely low stock valuation, so it may be a good acquisition target from its peers. This is even more so if there are no issues with the company’s financial performance or asset composition. If greater scale economies and a better value chain result will be achieved with the acquisition, improving profitability will be easy, and the higher profitability will lead to a higher stock valuation (of the acquirer), thereby leading to a situation of business value creation. Economic welfare will increase, and nothing bad will happen (except to the management of the acquired company who will likely be let go). Thus, in the second reason, keeping an eye on the stock price is important in order to preclude becoming the target of one’s peers or dishonest investors. To be precise, it is stock valuation, not the stock price. Some may well argue that hostile take-over will not fit well with the harmonious Japanese culture and especially if the large part of the company’s stock is held by the family or cross shareholdings threats are limited and it is an exaggeration to be so alarmful. However, it is also an eye-catching truth that Japanese pension is starting to face outflows due to aging as well as Bank-led cross shareholding tradition is becoming obsolete due to harsher Basel regulation on holdings of risky assets by banks. Nobody really discussed the consequence of these phenomenon, but people should be, by now, painfully aware that unless foreign shareholders replace such block of shareholdings these companies will have less shareholders to support the business moving forward. It is a positive development as companies in Japan are more keen to create a strong website as well as more detailed and investor friendly IR documents but if such is conducted just for the sake of raising the share price to an un-reasonably high level (maybe to do new issuance to acquire another high-valued company) it can be un-sustainable and shareholders will be disappointed some day to leave with an extremely bad taste. I believe there are only rare cases where managements think of such shrewd tactics. It can be well applauded when managements have in their mind what to do (contingency plans) if he or she feels the stock price is too cheap compared to what is believed to be a fair value. Such attitude and approach should be the correct one. Coming back to real basics, I feel that it is a wonderful thing for the company’s shares to be publicly tradable. It is the sign of responsibility, importance for the society to be public and managements and employees can be proud of being part of such organization. Not to mention, one of the clearest benefit of a company to be public is that the shares are easily tradable daily. The stock price can be seen as a barometer of the company, a PR tool, a tool that aligns managements’ and employees’ interests, a tool to give back to society as dividends what it has achieved over time, and a tool for non-organic breakthrough – M&A. Of course there are both good and bad things about how the Capitalism works and it is creating a lot of disruption especially in political areas. Still, it is one of the most valuable inventions of mankind and there are apparent benefits in using them wisely. I urge you not to waste this valuable asset of yours (being publicly tradable) and not to let it wag your business rather than wagging it yourselves. I believe those managements who understands that daily stock price is somewhat noise but also have the capability to take into consideration that stock price can be integrated and utilized in their corporate strategies would thrive and ecome leading companies in their respective industries. |

Thank you

Yuya Shimizu