Hibiki Message

A Brief Essay About ‘Dividends’

|

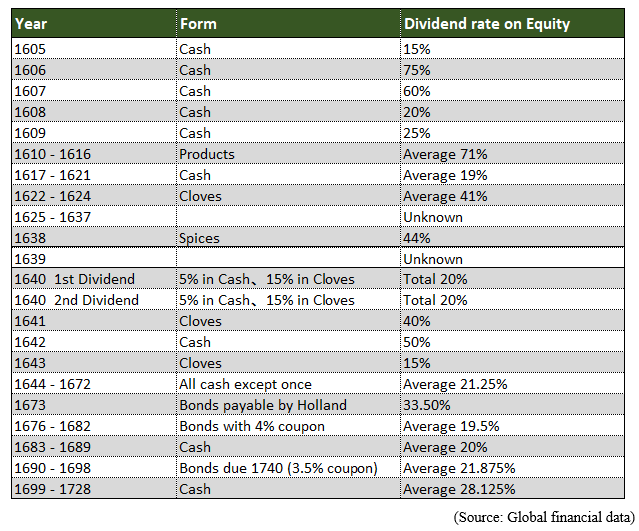

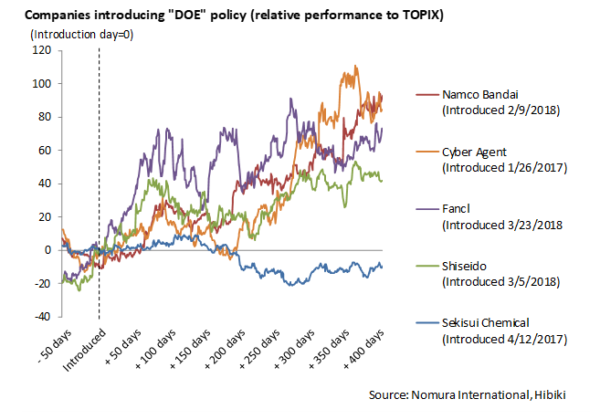

Letter to Management of Investee Companies This is Yuya Shimizu of Hibiki. This time, I had written a brief essay about ‘dividends’. For those of you receiving a letter from me for the first time, you might be surprised. But please do not worry. I regularly send this kind of letter to management teams of our investee companies to exchange ideas and thoughts, aiming to provide you some perspective in running your business. Letters are rarely sent or received these overly-digitalized days, and that is why we like to do it. We hope you like it too. Dividend is a very important issue for companies to handle each year, and as it is the only income shareholders can receive for the stocks they own (unless they dump it), it is also extremely important for shareholders too. First of all, what is actually the root of dividends? It is not so well known, so this time let us try to untie the knots from the perspective of the History of Capitalism. Many of you may have watched the big hit movie, the action-packed blockbuster released by Disney called “Pirates of the Caribbean” starred by Johnny Depp. The leader of the British Navy Sir Becket that took all the trouble to chase the notorious pirate Jack Sparrow was quite impressive. Sir Becket’s East India Trading Company was modelled from the East India Company of Britain, which was born in 17th Century to become one of the very early roots for Capitalism. Often cited as the first stock-based corporations in the world are the British East India Company and the Dutch East India Company (or VOC that stands for “Verenigde Oost-Indische Compagnie”), but the history of the first “limited-liability” company in its present form, according to various history reports, is the Dutch East India Company. It is also known that in this great age of exploration, Britain and the Netherlands that possessed the strongest navy then explored and colonized Africa, America and Asia, making fortunes from bringing back gold, silver, tea and spices. However, Ocean trades then were filled with risks, and the possibility of vessels returning safely was limited, so the risk of funding these voyages was crazy high. As such, people started funding several voyages together to diversify the risk, and it then eventually lead to the invention of “limited-liability” method which revolutionized the world. This, in fact, is marked as the start of true capitalism that has grown our world to date. The Dutch East India Company had the King of the Netherlands as its Governor (equivalent to a Chairman nowadays) and was established in 1602 as an amalgamation of various companies. In other words, it was a company that had military, administrative authority and monopolistic state-owned trading rights, and so was treated as a national project. At the same time as the company was established in Amsterdam, the world’s first stock exchange was borne there too, and the stocks of the Dutch East India Company were traded there. Before the setup of the Dutch East India Company, the Portuguese was the dominant ocean traders in the 16th century however the Dutch that could supply hundreds of vessels through the abundant capital supply by “limited-liability method” soon took over, and making use of Batavia (now called Jakarta) in Indonesia as its hub, it spread its wing to other parts of Asia, including Taiwan, Japan and China to trade and generate huge profits. It was indeed a very dynamic history, but let us step back, and have a look at the dividend policy of the Dutch East India Company. The following table is the brief history of its dividends over the long period of time (some years are still unknown). There are a few features. (1) Dividends to stock holders were calculated based on the ratio to Net Assets (i.e. Dividend-on-Equity “DOE”), and then (2) The DOE rate was extremely high. We can see that the initial investors recovered far more than their total investment within a few years all in cash. This is very attractive to investors, but (3) As the trade expanded beyond Batavia (Jakarta) to other places like Taiwan and Japan, cost had also increased eating its free cashflow, and as a desperate measure, payment-in-kind was introduced. Further, (4) In the later years, when push came to shove, it started paying-out dividends with government bonds. Alchemy? or bogus dividends? The fact showed that it was no more in a position to continue as an ongoing concern. Later on it faced credit squeeze, and finally after business became a financial wreck, it was essentially taken over by Britain’s East India Company. The story had many versions, but the root cause was deemed to be the following three points. Despite the stock price became inflated, it maintained excessive dividend: The average DOE for 200 years or so during the existence of the company was said to be about 18%. However, due to high stock price, actual dividend yield was said to be around 5-7%. Introduction of Payment-in-Kind: As the company went into distress, dividend payment was made in left-over goods which obviously left a bad taste in the eyes of investors (i.e. what am I supposed to do with this sack-full of pepper!), so many investors sold off their stocks. Taking notes on this, the British East India Company always paid out dividends in cash that earned the trust from investors. No add-on Equity Issuance: In capital markets, the most interesting feature is that the stock price is dependent on ‘sentiments’ and it can move the price up or down excessively. And using the fluctuation brilliantly will enable companies to obtain favorable terms to raise more capital (at a premium). However, VOC never took advantage of such capital market features to raise funds, and in later years, it resorted to issuing bonds. This made their future financing even more difficult from hindsight. As expected, in the 18th century, France and Spain caught up and also started sending their vessels to the present day North America and South America to strike fortune. Especially in France, with the help of Mr. John Law, originally from Scotland, human history’s one of the largest bubbles economy was about to take off. The situation was such that the Amsterdam’s position as top international financial market was quickly fading in front of booming new financial markets in the other parts of Europe. By the way, John Law is famous for establishing the world’s first Central bank in 1717, funded both by him and King Louis XV (and various government bills), eventually merging it with the Mississippi Company which had 25 years developing rights around Mississippi River in North America. By selling dreams to people, it became a funding machine by issuing vast amount of stocks to the public. He was, in a way, a magician combining the government capability to issue fiat money circulating it to come into fund Mississippi Company’s business leading into one of the most famous bubble economy and eventual collapse in history. Against such excitement in the same period, it was not difficult to imagine that VOC faced a strong pressure to maintain its high dividends to continue to attract its shareholders. We have observed how things started in Capitalism and how dividend was used to attract shareholders. Dividend is a genuine right of any stockholder. It is essentially a “ticket” issued by companies to attract shareholders who are about to invest into a highly-risky project with all the red flags that may completely wipe you them out if things go awry. As to the level of dividend, maintaining an excessively high level of dividends without much consideration to business profitability leads to ‘business failures’, as it did with VOC. It involves principal-agency issues which still happens to be the case in current world. Business with (or perceived to have) good growth potential, can get around without paying dividends, as the shareholders will be happy (such as today’s Amazon) to dream on their futures but they are rare in this world – so Dividend plays an important role. Then, what is the best dividend policy? It may sound like teaching a fish how to swim when I ask you this question (please allow me), but there are three concepts as described below. I believe you are all questioning yourselves every day about it. A. Steady (stable) Dividend: A certain yen of dividend to be paid out each year without change In Japan, General Headquarters of the allied forces (“GHQ”), after the second World-War (“WWII”), has conducted a major purge of government officials but it also spread widely to Corporate owners and Corporate Representatives who has, willingly or not, supported the war. Next generation CEOs were chosen from senior working level employees and due to their nature, Capitalist driven policies such as high dividend payout (which, by the way, was the absolute norm prior to WWII in Japan!) was completely hammered into bits and pieces. Additionally, as Japan went into long period of strong growth during 1950s – 1970s, in order to secure growth capital, management teams became generally inclined to “save” cash by paying as minimum dividends as possible. As a side note, there is a tradition of life-time employment, as well as the salary of employees in their earlier days being suppressed (then at later time company pays senior employee far higher than their real value in return to compensate for the long-term loyalty). Cross-shareholding structure in the stock market is also something very unique about Japan. All of these traditions, as well as the stable-and-low dividend payout mindset were developed during this time after the WWII when Japan was going through phenomenal recovery from ashes and growth – it was basically a wholistic approach to sacrifice everything else for corporate prosperity. I wonder how you have gone through this time of hyper tension and excitement. I would be delighted to have casual and personal discussion on how you perceive of this era which is still probably one of the most exciting time for Japan in our history. In recent years, the concept of Dividend based on Pay-out Ratio (‘B’) and Dividend-on-Equity (‘C’) has become more commonly adopted by many companies, which means Japan is moving towards a more capitalist market in their rationale. Both have their advantages, and there are some precautions to take too. From here onwards, the contents are purely my own personal opinion, and I would like to put forward several observations. I would place a bid that more companies should opt for Dividend-on-Equity going forward. If, for example, Dividend based on Pay-out Ratio is adopted, and management considers to divide and share 1/3 of the profit each year for the growth of the company (retained income), another 1/3 to be distributed to the employees (bonus and also budgeting for training), and the last 1/3 for the shareholders, it is a ‘good for everyone’ philosophy based on the idea of Ohmi merchants (Ohmi area was famous for active merchants) that is quite rational. The only problem is that in business sectors with huge cyclicality and earnings volatility, dividends will fluctuate widely each year. If it is hard to forecast the trajectory of dividends of a company over time, naturally it will result in negative assessment which may cause a body blow to the valuation of this company. Therefore, as we all know, companies try to blend the dividend policy between a certain pay-out ratio target (‘B’) and a minimum steady level dividends (‘A’). When combining above mentioned minimum steady level dividends it implies that companies are trying to narrow down the fluctuations of dividends. However, it raises other issues; “How to define minimum dividends?”. I have to say that there are numerous cases where the ‘theoretical background’ of defining a lower floor in dividend is unclear. In many cases it is just a linear trajectory from the past (which was formed in the “high growth era in Japan”). In our view, by replacing this Steady Dividends policy with DOE there are many positive side-effects. Let me elaborate a little further. The effects of introducing DOE 1. Dividends will be fully linked to increase/decrease of (book) equity value 2. It “implies” the commitment without clearly “mentioning” it 3. It naturally leads (without thinking) to Financial Discipline When business performance fluctuates significantly, there are many companies that have a hard time in making decisions on dividends. Here, by introducing DOE, they can get rid of the predicament on what should be the level of dividend which is a very delicate and difficult decision to make. It will save a lot of brain power for the management to think about more crucial and strategic issues that determines the long-term direction of the company. Of course if you set the DOE level too high, it cannot be maintained (that should be considered as the biggest harmful effect and risks). It should be sustainable in the first place, and the introduction of DOE can be utilized in helping the company to achieve a better disciplined financial balance over the long-term (without thinking!). In Japan, Pharmaceutical companies tend to have higher proportion of adopting DOE as the official dividend policy or just express it as one of the important KPIs (key performance indicators) in terms of financial metrics to follow closely. The background behind it is that the cycle for developing a new drug can be dauntingly long – from a few years minimum to often more than 10 years, with heavy R&D burden. During the time of development, profit maybe depressed and when FDA approves the drug then windfall profits will be granted – a wild wild west business. It is extremely hard and risky to forecast how things would turn out and so DOE maybe a practical solution to “keep the shareholders supportive” during tough times. Lastly, major companies that have “newly” introduced DOE policy in the past 3 years are shown below. Althouh it is based on only a very short time frame of 400 days, we can observe that introduction of DOE generally works in favor of stock prices. 4 out of 5 companies in the list significantly out-performed the Topix index during 400 days after the introduction. It does not seem to be a coincidence. It is very inspiring to know, that, in the history of stock markets, dividend pay-out ratio (based on profits each year), which is currently more widely used, is a later-introduced concept compared to the concept of DOE. We commonly use Return-on-Equity (profitability ratio with book net equity as denominator) as one of the most reliable profitability method then why not come back to DOE? Now we know that it has been very widely used in the early days of capitalism, and there are some certain logical backbones for it too. Thank you for reading this letter while I know you are all very busy for year-end. We have discussed about DOE this time and I hope you enjoyed it. There are many companies in our portfolio who has already introduced DOE policy but it is far from majority at this point. I am not trying to be overly pushy but I hope you to consider DOE as your future dividend policy as it is much better than you might imagine. More than anything else, take good care of your health. May next year be even more prosperous to you all! December 2019 Yuya Shimizu |