|

Dear executives of investee companies,

This is Yuya Shimizu of Hibiki Path Advisors. Greetings for year 2019. Current Emperor will step down in April and we will have a new name era that will follow Heisei. It is at least emotionally a big change for us Japanese and we would like to make it a good positive catalyst for our better life.

Each time, I poke you with variety of different themes, and this time around it is “Corporate value, value that should be protected and cultivated, and life cycle of such”. We now live in an era with no shortage of devastating surprises and shocking incidents in both social and international affairs. Last year one shocking thing I saw made me think deeply. I would like to share it with you here which is actually words from Jeff Bezos, the founder of Amazon. In a casual meeting with his employees when he was asked an opinion on bankruptcy of Sears, he responded like this.

“Amazon is not too big to fail … In fact, I predict one day Amazon will fail. Amazon will go bankrupt. If you look at large companies, their lifespans tend to be 30-plus years, not 100-plus years … If we start to focus on ourselves instead of focusing on our customers, that will be the beginning of the end … We have to try and delay that day for as long as possible.”

This is quite a shocking statement considering it came out from the mouth of a 75 trillion Yen market value company even with the understanding that he has notoriously offensive character. We can digest the comment from various perspectives. One is that he may be trying to instill in his employees a sense of crisis, and the other may be that he is truly pessimistic about the future of Amazon, especially after he has left the scene. Anyway, no one really knows what his real intention is. My take on the comment concerns above mentioned “Corporate value, value that should be protected and cultivated, and life cycle of such”

24 years’ old

Amazon was founded in July 1994, so now it is 24 years’ old; it started by selling books through the Internet but the grand plan was also to sell all sorts of merchandize that can be purchased by consumers. In 1997, it went public, and the firm expanded its business tremendously that includes providing Cloud service. Bezos is now 54 years’ old, he can continue to run the company for decades more if he is willing. However, starting from a staff of 600 when it went public, it now has 600,000 people working for the firm and it is HUGE. I would not be surprised Bezos started to feel he will need to re-install the paranoid nature that has led his empire to get to this stage before his mental energy starts to decline.

The background and the reason why the firm can grow so fast was described in details in a book by Bloodstone written in 2014, after interviewing Jeff Bezos himself for more than 10 times. And that simple ‘corporate philosophy’ was quoted in its annual report too in 1997 to its shareholders, and even now we can view it each year, which is as follows.

Obsess over long-term + Obsess over customers

“Obsess” is actually a very strong word. It implies stress. Also, the concept is uniquely simple as business philosophy or mission; it does not mention anything about the vision or the business. But rather, all energies are reserved for the long term, and customer satisfaction is the priority. The click of a customer occurs every day, and it will push everybody involved to view things on incremental short-term basis. When ‘obsess’ – a word with a strong sense is used, the real meaning is there, to kill this short termism that would evolve within the organization on a daily basis.

This ‘endless strive’ nature underpins the success of Amazon, that keeps on improving and maintaining its service and without it, sustainability of this organization will be in jeopardy.

100-year corporations

Changing the topic, one of the pride that Japan has in the world is its many long-established firms. There are more than 30,000 companies aged more than 100 years, which is quite rare in the world. According to Tokyo Commercial and Industrial Research, there would be additional 1,760 firms joining this “100 years club”, including Panasonic, and the trend is on the rise. Running a company for more than 100 years is an amazing thing for sure. However, what remains within the company after this 100 years is something more important.

Among the group, the one with considerable scale and history is Sumitomo Metal & Mining (SMM), which started as a copper smelter in 1590, and later on became a company in 1691; today with revenue of more than 900 billion yen – a global smelting company active in resources development as well. It seems crazy but I would like to point out that these two companies (SMM and Amazon) have one thing in common – of course, they are different in most of other aspects. In the integrated disclosure report issued by SMM, in its first page, “Sumitomo business spirit” is always stated, using its original phrasing; summary as follows – (1) To value trust, and (2) Be flexible to move with market circumstance, and that (3) Work with long-term profits in mind, not about cash today or tomorrow.

In its long history there were a few occasions where the company was facing crisis conditions with risks of bankruptcy. Nonetheless, it could overcome all crisis based on above described basic, simple philosophy, whereby the company as a whole relies as principle. Despite the founder having left the company long ago, these principles are shared as common values within all levels of the company.

Life cycle

While many companies do survive for more than 100 years, the pace of their life-cycle is getting faster, and at the same time, the life-span is getting shorter (perhaps this is what Bezos meant). In a global environment that is becoming flatter and value-add or excess profit evaporating faster than ever, merger of companies are one of the means to compensate with this speed, and in this context, key value that companies should rely or protect, whether it is one’s own ‘company brand’ or ‘business’ or ‘the underpinning spirit and philosophy’ gets all mixed up in chaos.

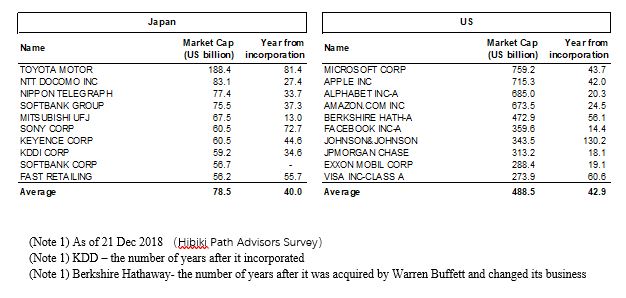

Below is a comparison of the top 10 Japan and US companies in terms of current market capitalization and it describes how many years since being in a current form.

We can see the number of years after their establishment as a company in current setting, for instance, MUFG which is a merger between Tokyo Mitsubishi Bank and UFJ Bank. In the same way, in the US, there is JP Morgan Chase Bank – which started off as a partnership between Mr. Morgan and Mr. Drexel 147 years ago, and Exxon Mobil, setup by Mr. Rockefeller as Standard Oil, of which the name does not remain after 148 years.

What is interesting is that in selecting the top 10 companies in terms of current capitalization, regardless of the technical condition, the average number of years is about 40 years in both Japan and the US, and this data provides some degree of relevance to the ’30 year corporate lifecycle thesis’ that has been wide spread in the market. It can come in the form of merger, acquisition or corporatization, but as it develops and grows, it undergoes metamorphosis and ‘changes its shape’ in 30 years. Even companies such as Microsoft, Bill Gates, has stepped down from official business activities since 2006. So is Apple, when Steve Jobs passed away in 2011. All of these newly established corporations also went through changes when they were around 30 years old.

From these facts, we can assume that even if a company is at its prime at the age of 24, as Amazon’s Bezos has pointed out, ‘the future’ has to be considered, and the philosophy has to be scrutinized to re-start the process.

Theoretically, the value of the company (equity value) is, a discounted present value of all of its future cashflow and that equates to the current market cap. But, Keynes’ theory on ‘Beauty Contest’ comes into the picture, which is temperamental in nature. However, Benjamin Graham, the mentor of Warren Buffett and a legendary value investor, left below interesting quote;

In the short run, the market is a voting machine but in the long run,

it is a weighing machine.

It is self explanatory that in the short run it is all about buyers and sellers and where it balances, but if we compare the changes in the past 3 years, or 5, 10 years, somehow there is ‘a weight’ that determines the value of a corporation. Bezos of Amazon quoted this phrase twice in his annual letter to shareholders – in the year 2000 when stock price dropped to one quarter from its peak due to Internet bubble despite business being in great shape, and in 2012 when stock price gained 45% while business remained healthy but just going as planned.

If we weigh it with a scale, of course, we look at the profit level and the growth rate. But actually, the background is those things that support the profit or profitability, and perhaps you may agree that ‘the value that should be protected’ is the corporate philosophy, or the corporate beliefs, which will generate both coherency and flexibility which should lead to long-term confidence by investors. For example, one of our investee companies is a company called Kadokawa, and its corporate philosophy is ‘不易流行’. It’s a concept derived from the Haiku poem of Basho Matsuo, mentioning that one has to make decision concerning what should be changed and what should not be changed, in order to keep the values and having the mindset to be flexible. We feel it is a great corporate philosophy that has supported the company to date.

Company will change for sure, just like human beings, it has a life-cycle, which is obvious when we look at the top 10 companies in terms of market value.

Finally, let’s have a look at some interesting statistics, again from the viewpoint of “Corporate value, value that should be protected and cultivated, and life cycle of such”. The above number ‘4336’ is the number of corporations listed in the US, whereas ‘2826’ is the number of corporations listed in Japan. (*due to lack of continuous date we have excluded JASDAQ, but if we also included them the number would be 3,602)

US GDP is about 4 times that of Japan, but nevertheless, but US only has twice as much public companies compared to Japan. Further, in US, while there are average of 160 new IPOs each year, number of companies shrunk 40% since 2000 which is striking. This shows the different market dynamism in the two market (in the US M&As and take-overs are daily affairs).

During M&A transactions, merger ratio or the price is the critical issue, but in the long-run, it is just like people getting married after a few decades of their respective lives where the ‘fit’ derived from the similarities and difference in personal characters becomes crucial. Corporate philosophy is what makes those corporate characters which would determines the ‘fit’.

Maybe it is a stretch to always consider non-organic changes such as M&As, but in an environment where changes are fiercely becoming rapid, if we stop our drive for ‘change’, it immediately means crisis. We, Hibiki, are very supportive of creative destruction as it typically strengthens the organization, but we do sympathize that it comes with huge cost not only from the viewpoint of business continuity, but also in terms of internal motivation management issues and it is easier said than done for large companies to do that organicly. So, the easier executable strategy and obvious answers for anxious management teams would be considering business combinations through mergers, acquisitions (both buying AND selling your company), business division recapitalizations, and many others to take place – is there really any better means out there that will preserve your ‘real important value’? When we look at the history of top corporations in the US as we did, it seems the answer is quite obvious.

In your company, what is the most important value to protect and to cultivate over the long term? How did it derive and transform itself in the long history of running, and how would it evolve going forward? What measure do you want to take to do that? I am more than happy to think about it together with you.

Sincerely,

|